- India

- /

- Marine and Shipping

- /

- NSEI:TRANSWORLD

Did Business Growth Power Shreyas Shipping and Logistics' (NSE:SHREYAS) Share Price Gain of 224%?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Shreyas Shipping and Logistics Limited (NSE:SHREYAS) share price has soared 224% return in just a single year. On top of that, the share price is up 191% in about a quarter. Unfortunately the longer term returns are not so good, with the stock falling 52% in the last three years.

See our latest analysis for Shreyas Shipping and Logistics

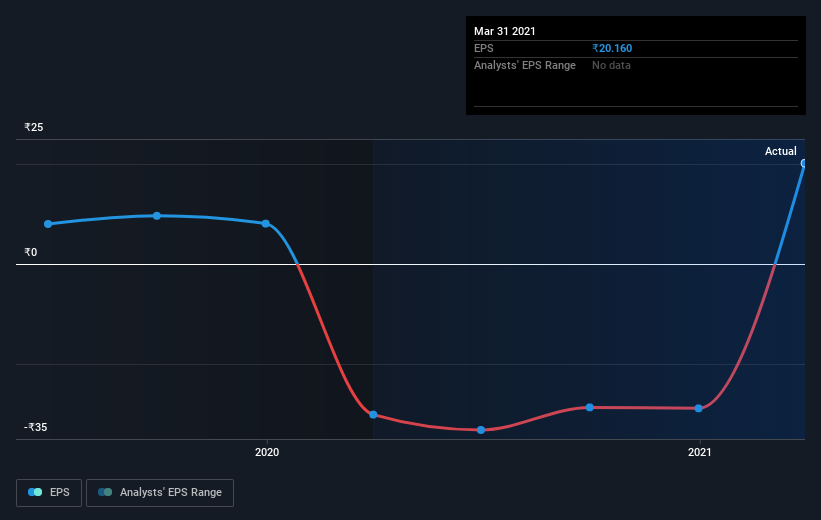

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Shreyas Shipping and Logistics went from making a loss to reporting a profit, in the last year.

We think the growth looks very prospective, so we're not surprised the market liked it too. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Shreyas Shipping and Logistics' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Shreyas Shipping and Logistics shareholders have received a total shareholder return of 224% over one year. Of course, that includes the dividend. That certainly beats the loss of about 7% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Shreyas Shipping and Logistics (including 2 which make us uncomfortable) .

But note: Shreyas Shipping and Logistics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Shreyas Shipping and Logistics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Transworld Shipping Lines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TRANSWORLD

Transworld Shipping Lines

Provides coastal container shipping in India and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives