- India

- /

- Transportation

- /

- NSEI:SHREEOSFM

Om Sai Fleet Management India Private Limited (NSE:SHREEOSFM) Soars 27% But It's A Story Of Risk Vs Reward

Om Sai Fleet Management India Private Limited (NSE:SHREEOSFM) shares have continued their recent momentum with a 27% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

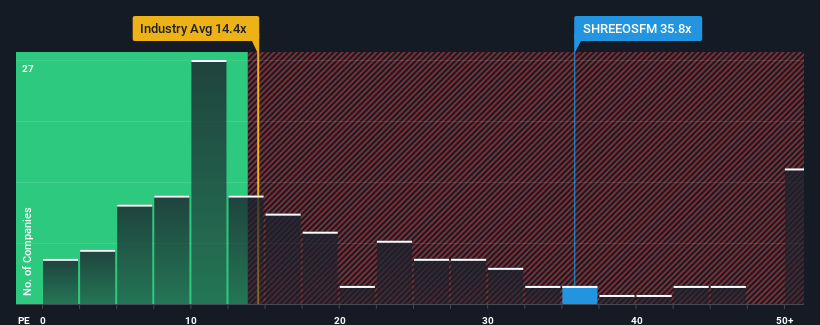

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Om Sai Fleet Management India Private's P/E ratio of 35.8x, since the median price-to-earnings (or "P/E") ratio in India is also close to 34x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Om Sai Fleet Management India Private as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Om Sai Fleet Management India Private

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Om Sai Fleet Management India Private's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 138% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 708% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Om Sai Fleet Management India Private's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Om Sai Fleet Management India Private's P/E

Om Sai Fleet Management India Private's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Om Sai Fleet Management India Private currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Om Sai Fleet Management India Private (2 are significant!) that you need to take into consideration.

If you're unsure about the strength of Om Sai Fleet Management India Private's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHREEOSFM

Excellent balance sheet with proven track record.

Market Insights

Community Narratives