- India

- /

- Marine and Shipping

- /

- NSEI:ORICONENT

Oricon Enterprises' (NSE:ORICONENT) Dividend Will Be Reduced To ₹0.50

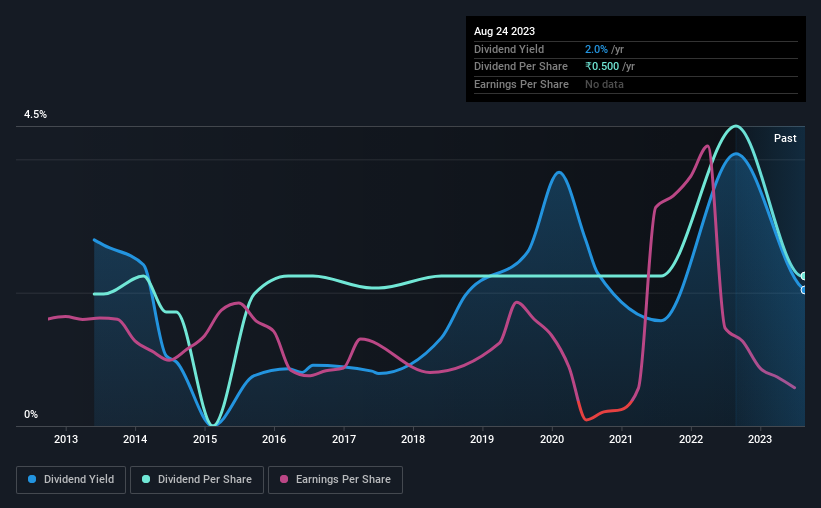

Oricon Enterprises Limited (NSE:ORICONENT) is reducing its dividend from last year's comparable payment to ₹0.50 on the 21st of October. This means that the dividend yield is 2.0%, which is a bit low when comparing to other companies in the industry.

See our latest analysis for Oricon Enterprises

Oricon Enterprises Doesn't Earn Enough To Cover Its Payments

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, Oricon Enterprises' dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. This is a pretty unsustainable practice, and could be risky if continued for the long term.

Looking forward, EPS could fall by 14.3% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 117%, which could put the dividend in jeopardy if the company's earnings don't improve.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the dividend has gone from ₹0.44 total annually to ₹0.50. This implies that the company grew its distributions at a yearly rate of about 1.3% over that duration. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Oricon Enterprises' EPS has fallen by approximately 14% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 3 warning signs for Oricon Enterprises you should be aware of, and 1 of them is a bit unpleasant. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORICONENT

Oricon Enterprises

Engages in manufacturing, trading, and sale of plastic closures and preforms in India and internationally.

Medium-low with adequate balance sheet.