- India

- /

- Marine and Shipping

- /

- NSEI:ORICONENT

Does Oricon Enterprises (NSE:ORICONENT) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Oricon Enterprises Limited (NSE:ORICONENT) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Oricon Enterprises

What Is Oricon Enterprises's Net Debt?

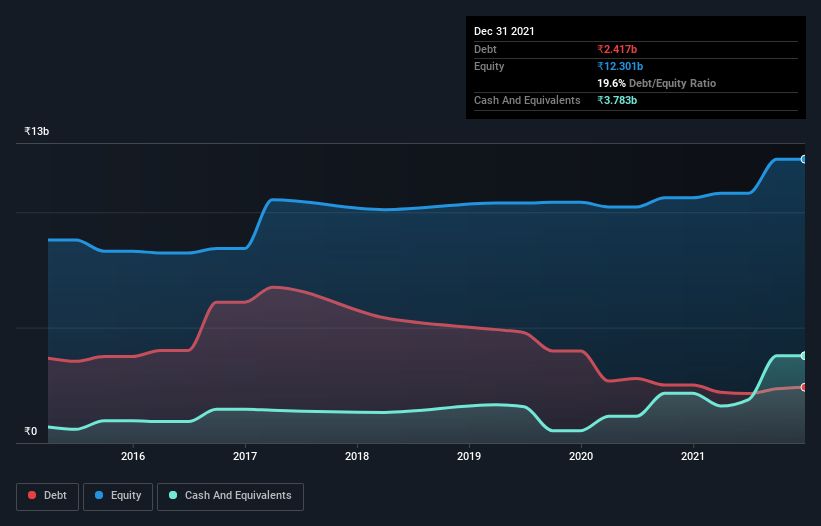

As you can see below, Oricon Enterprises had ₹2.42b of debt, at September 2021, which is about the same as the year before. You can click the chart for greater detail. However, it does have ₹3.78b in cash offsetting this, leading to net cash of ₹1.37b.

How Strong Is Oricon Enterprises' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Oricon Enterprises had liabilities of ₹2.81b due within 12 months and liabilities of ₹995.4m due beyond that. Offsetting this, it had ₹3.78b in cash and ₹1.48b in receivables that were due within 12 months. So it actually has ₹1.46b more liquid assets than total liabilities.

This excess liquidity suggests that Oricon Enterprises is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Oricon Enterprises boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Oricon Enterprises will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Oricon Enterprises reported revenue of ₹7.0b, which is a gain of 4.8%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Oricon Enterprises?

While Oricon Enterprises lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of ₹1.4b. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Oricon Enterprises is showing 4 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORICONENT

Oricon Enterprises

Engages in manufacturing, trading, and sale of plastic closures and preforms in India and internationally.

Adequate balance sheet slight.