Reflecting on Future Supply Chain Solutions' (NSE:FSC) Share Price Returns Over The Last Three Years

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Future Supply Chain Solutions Limited (NSE:FSC) investors who have held the stock for three years as it declined a whopping 86%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the ride hasn't got any smoother in recent times over the last year, with the price 76% lower in that time. Unfortunately the share price momentum is still quite negative, with prices down 13% in thirty days. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Future Supply Chain Solutions

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

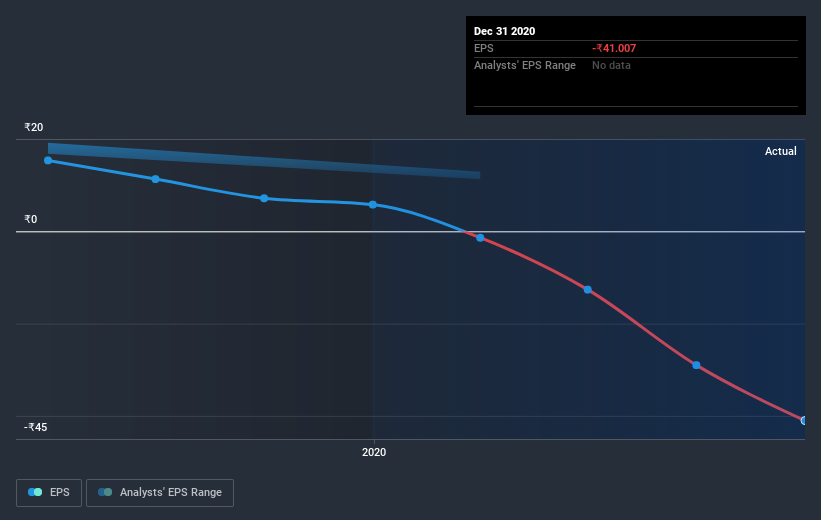

Future Supply Chain Solutions saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Future Supply Chain Solutions' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Future Supply Chain Solutions shareholders are down 76% for the year, but the broader market is up 40%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 23% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Future Supply Chain Solutions is showing 3 warning signs in our investment analysis , and 2 of those are concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Future Supply Chain Solutions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Future Supply Chain Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:FSC

Future Supply Chain Solutions

Together with its subsidiary, provides third-party supply chain solutions and logistics services in India.

Very low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives