- India

- /

- Telecom Services and Carriers

- /

- NSEI:TTML

Tata Teleservices (Maharashtra) Limited (NSE:TTML) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Tata Teleservices (Maharashtra) Limited (NSE:TTML) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

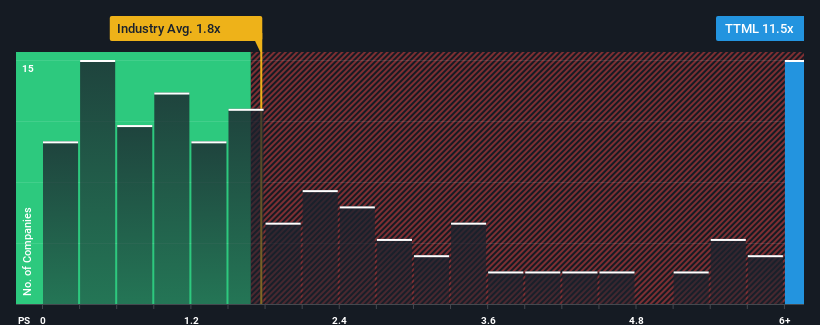

Following the firm bounce in price, given around half the companies in India's Telecom industry have price-to-sales ratios (or "P/S") below 2.9x, you may consider Tata Teleservices (Maharashtra) as a stock to avoid entirely with its 11.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Tata Teleservices (Maharashtra)

How Has Tata Teleservices (Maharashtra) Performed Recently?

Tata Teleservices (Maharashtra) has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tata Teleservices (Maharashtra) will help you shine a light on its historical performance.How Is Tata Teleservices (Maharashtra)'s Revenue Growth Trending?

In order to justify its P/S ratio, Tata Teleservices (Maharashtra) would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 9.8% gain to the company's revenues. The latest three year period has also seen a 20% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.8% shows it's about the same on an annualised basis.

In light of this, it's curious that Tata Teleservices (Maharashtra)'s P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What We Can Learn From Tata Teleservices (Maharashtra)'s P/S?

The strong share price surge has lead to Tata Teleservices (Maharashtra)'s P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't expect to see Tata Teleservices (Maharashtra) trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Tata Teleservices (Maharashtra) has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you're unsure about the strength of Tata Teleservices (Maharashtra)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Tata Teleservices (Maharashtra), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tata Teleservices (Maharashtra) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TTML

Tata Teleservices (Maharashtra)

Provides wire line voice, data, and managed telecom services to enterprise customers in Maharashtra and Goa.

Imperfect balance sheet very low.

Similar Companies

Market Insights

Community Narratives