- India

- /

- Wireless Telecom

- /

- NSEI:AIRTELPP

Is Now The Time To Put Bharti Airtel (NSE:AIRTELPP) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Bharti Airtel (NSE:AIRTELPP), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Bharti Airtel

How Fast Is Bharti Airtel Growing Its Earnings Per Share?

Bharti Airtel has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Bharti Airtel has grown its trailing twelve month EPS from ₹11.77 to ₹12.55, in the last year. That's a fair increase of 6.6%.

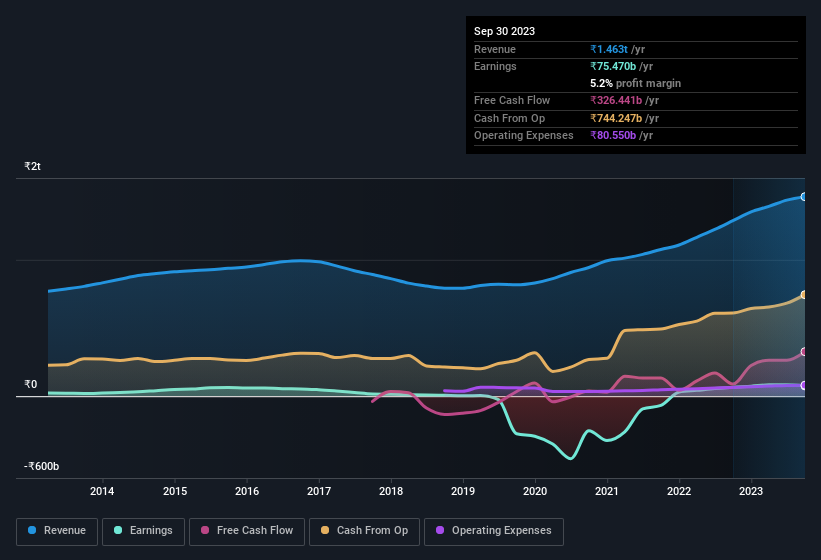

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Bharti Airtel shareholders is that EBIT margins have grown from 23% to 26% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Bharti Airtel's future profits.

Are Bharti Airtel Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₹6.1t company like Bharti Airtel. But we are reassured by the fact they have invested in the company. Indeed, they hold ₹1.0b worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.02% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Bharti Airtel Worth Keeping An Eye On?

As previously touched on, Bharti Airtel is a growing business, which is encouraging. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. However, before you get too excited we've discovered 3 warning signs for Bharti Airtel (1 shouldn't be ignored!) that you should be aware of.

Although Bharti Airtel certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bharti Airtel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AIRTELPP

Bharti Airtel

Operates as a telecommunications company in India and internationally.

Solid track record with reasonable growth potential and pays a dividend.