- India

- /

- Communications

- /

- NSEI:STLTECH

Sterlite Technologies (NSE:STLTECH) Has Announced That Its Dividend Will Be Reduced To ₹0.50

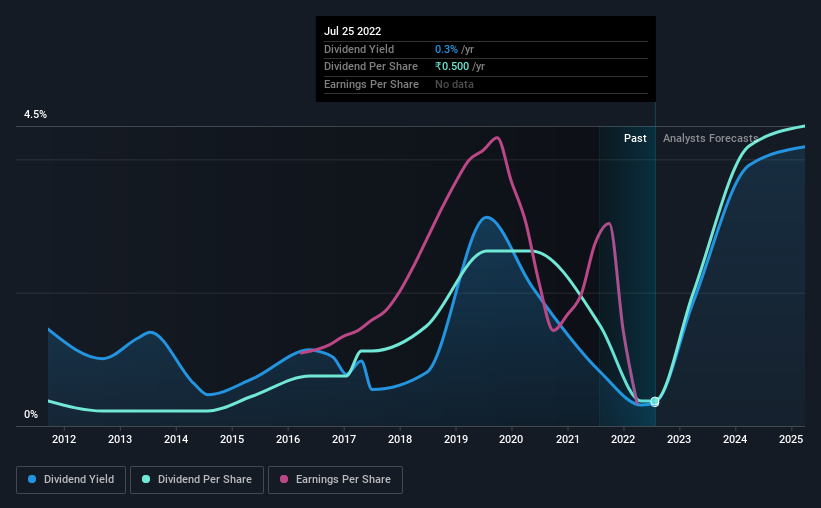

Sterlite Technologies Limited (NSE:STLTECH) is reducing its dividend from last year's comparable payment to ₹0.50 on the 25th of September. This payment takes the dividend yield to 0.3%, which only provides a modest boost to overall returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Sterlite Technologies' stock price has reduced by 35% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Check out our latest analysis for Sterlite Technologies

Sterlite Technologies' Payment Has Solid Earnings Coverage

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Prior to this announcement, Sterlite Technologies' earnings easily covered the dividend, but free cash flows were negative. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend extends its recent trend, estimates say the dividend could reach 2.9%, which we would be comfortable to see continuing.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The most recent annual payment of ₹0.50 is about the same as the annual payment 10 years ago. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Sterlite Technologies' earnings per share has shrunk at 25% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Sterlite Technologies (1 is a bit unpleasant!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:STLTECH

Sterlite Technologies

Manufactures and sells telecom products in India and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)