- India

- /

- Electronic Equipment and Components

- /

- NSEI:RISHABH

Rishabh Instruments (NSE:RISHABH) Might Be Having Difficulty Using Its Capital Effectively

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Rishabh Instruments (NSE:RISHABH), we don't think it's current trends fit the mold of a multi-bagger.

We've discovered 3 warning signs about Rishabh Instruments. View them for free.Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Rishabh Instruments, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.04 = ₹274m ÷ (₹8.7b - ₹1.9b) (Based on the trailing twelve months to December 2024).

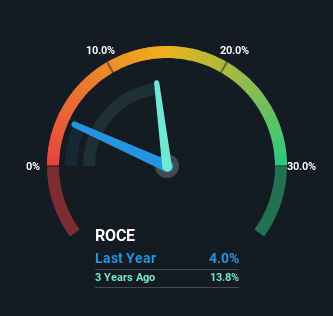

Thus, Rishabh Instruments has an ROCE of 4.0%. In absolute terms, that's a low return and it also under-performs the Electronic industry average of 14%.

Check out our latest analysis for Rishabh Instruments

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Rishabh Instruments.

The Trend Of ROCE

On the surface, the trend of ROCE at Rishabh Instruments doesn't inspire confidence. To be more specific, ROCE has fallen from 11% over the last four years. However it looks like Rishabh Instruments might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It may take some time before the company starts to see any change in earnings from these investments.

In Conclusion...

To conclude, we've found that Rishabh Instruments is reinvesting in the business, but returns have been falling. And in the last year, the stock has given away 42% so the market doesn't look too hopeful on these trends strengthening any time soon. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 3 warning signs for Rishabh Instruments (of which 1 makes us a bit uncomfortable!) that you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RISHABH

Rishabh Instruments

Engages in the design, development, and manufacturing of global energy efficiency solutions in electrical automation, measurement, and industrial technology in Asia, the United States, Poland, other European countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Sustained Silver at ~US$100/oz Drives Explosive Leverage and Re-Rating for PAAS

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.