- India

- /

- Electronic Equipment and Components

- /

- NSEI:OPTIEMUS

We Discuss Why The CEO Of Optiemus Infracom Limited (NSE:OPTIEMUS) Is Due For A Pay Rise

Key Insights

- Optiemus Infracom will host its Annual General Meeting on 22nd of September

- Salary of ₹4.50m is part of CEO Ashok Gupta's total remuneration

- The overall pay is 55% below the industry average

- Over the past three years, Optiemus Infracom's EPS grew by 126% and over the past three years, the total shareholder return was 475%

The impressive results at Optiemus Infracom Limited (NSE:OPTIEMUS) recently will be great news for shareholders. At the upcoming AGM on 22nd of September, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

See our latest analysis for Optiemus Infracom

How Does Total Compensation For Ashok Gupta Compare With Other Companies In The Industry?

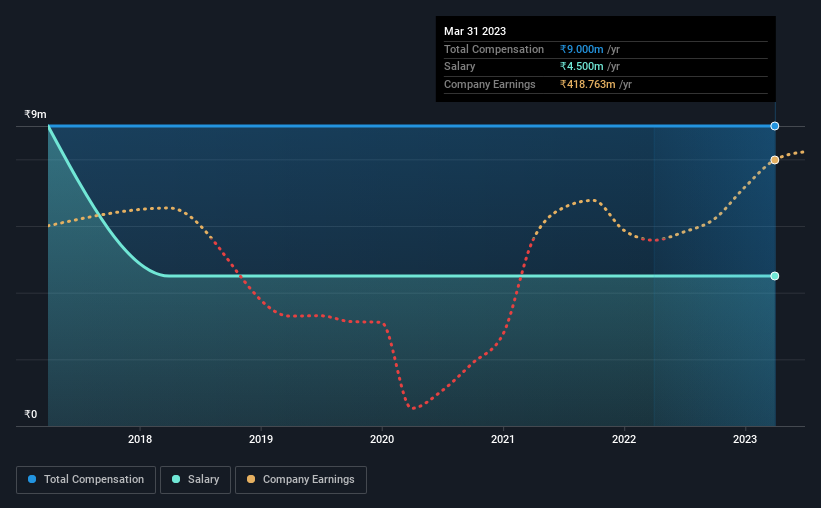

According to our data, Optiemus Infracom Limited has a market capitalization of ₹28b, and paid its CEO total annual compensation worth ₹9.0m over the year to March 2023. There was no change in the compensation compared to last year. In particular, the salary of ₹4.50m, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Indian Electronic industry with market capitalizations between ₹17b and ₹67b, we discovered that the median CEO total compensation of that group was ₹20m. That is to say, Ashok Gupta is paid under the industry median. What's more, Ashok Gupta holds ₹3.6b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹4.5m | ₹4.5m | 50% |

| Other | ₹4.5m | ₹4.5m | 50% |

| Total Compensation | ₹9.0m | ₹9.0m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. It's interesting to note that Optiemus Infracom allocates a smaller portion of compensation to salary in comparison to the broader industry.

A Look at Optiemus Infracom Limited's Growth Numbers

Optiemus Infracom Limited's earnings per share (EPS) grew 126% per year over the last three years. In the last year, its revenue is up 99%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Optiemus Infracom Limited Been A Good Investment?

Boasting a total shareholder return of 475% over three years, Optiemus Infracom Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Optiemus Infracom (1 is a bit unpleasant!) that you should be aware of before investing here.

Switching gears from Optiemus Infracom, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OPTIEMUS

Optiemus Infracom

Trades in mobile handset and mobile accessories in India and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026