- India

- /

- Communications

- /

- NSEI:ASTRAMICRO

While institutions invested in Astra Microwave Products Limited (NSE:ASTRAMICRO) benefited from last week's 6.8% gain, retail investors stood to gain the most

Key Insights

- Astra Microwave Products' significant retail investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- The top 18 shareholders own 51% of the company

- 10% of Astra Microwave Products is held by insiders

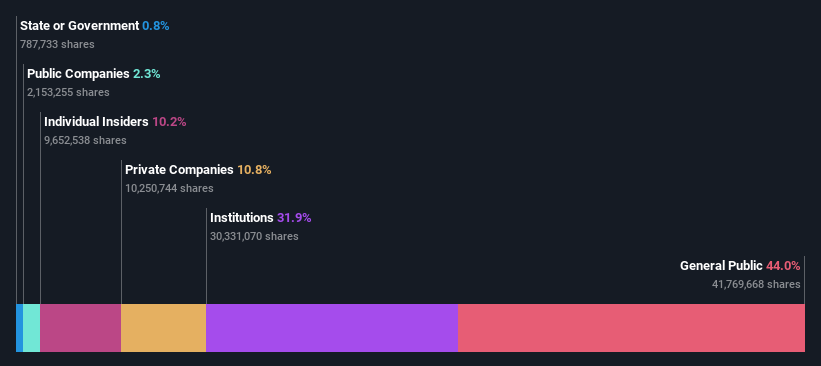

Every investor in Astra Microwave Products Limited (NSE:ASTRAMICRO) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 44% to be precise, is retail investors. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Following a 6.8% increase in the stock price last week, retail investors profited the most, but institutions who own 32% stock also stood to gain from the increase.

In the chart below, we zoom in on the different ownership groups of Astra Microwave Products.

Check out our latest analysis for Astra Microwave Products

What Does The Institutional Ownership Tell Us About Astra Microwave Products?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

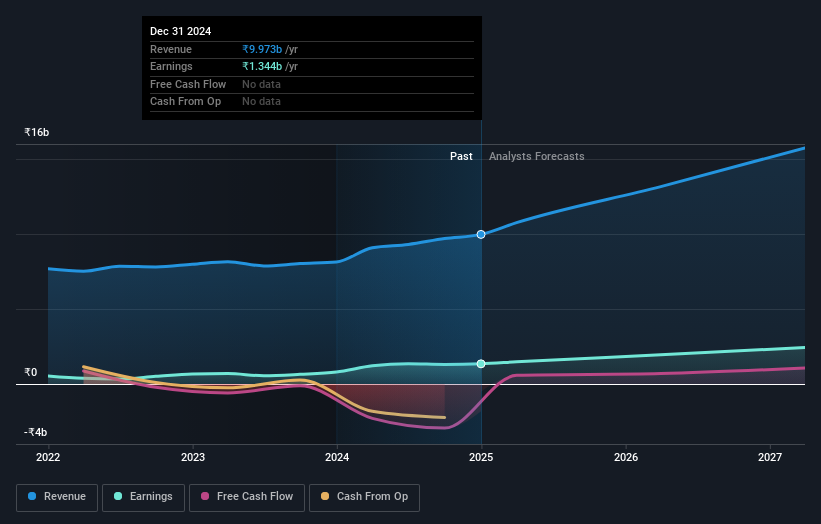

Astra Microwave Products already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Astra Microwave Products' historic earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Astra Microwave Products. Ratnabali Securities Pvt. Ltd. is currently the largest shareholder, with 6.3% of shares outstanding. For context, the second largest shareholder holds about 4.6% of the shares outstanding, followed by an ownership of 3.6% by the third-largest shareholder.

After doing some more digging, we found that the top 18 have the combined ownership of 51% in the company, suggesting that no single shareholder has significant control over the company.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Astra Microwave Products

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Astra Microwave Products Limited. It has a market capitalization of just ₹68b, and insiders have ₹7.0b worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 44% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Astra Microwave Products. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

It seems that Private Companies own 11%, of the Astra Microwave Products stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow .

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASTRAMICRO

Astra Microwave Products

Designs, develops, manufactures, and sells sub-systems for radio frequency and microwave systems used in defense, space, meteorology, civil, and telecommunication applications in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)