The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Aksh Optifibre Limited (NSE:AKSHOPTFBR) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Aksh Optifibre

What Is Aksh Optifibre's Debt?

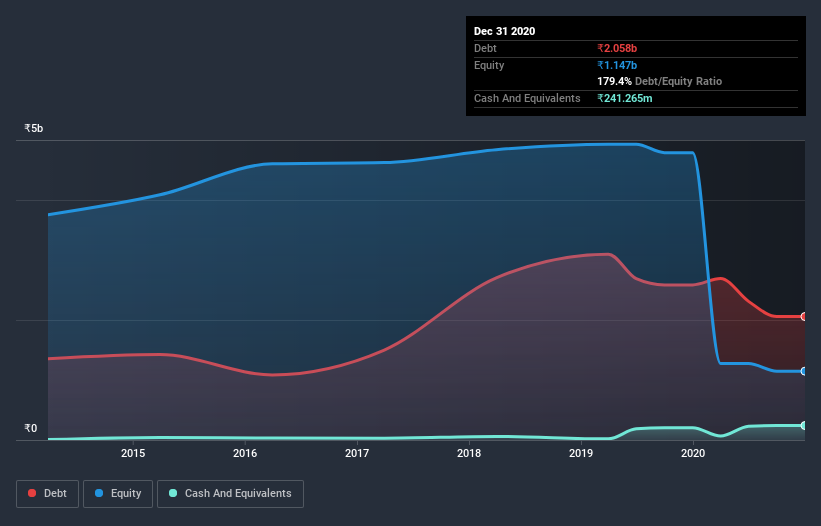

As you can see below, Aksh Optifibre had ₹2.06b of debt at September 2020, down from ₹2.59b a year prior. However, because it has a cash reserve of ₹241.3m, its net debt is less, at about ₹1.82b.

How Healthy Is Aksh Optifibre's Balance Sheet?

According to the last reported balance sheet, Aksh Optifibre had liabilities of ₹3.11b due within 12 months, and liabilities of ₹1.36b due beyond 12 months. Offsetting this, it had ₹241.3m in cash and ₹1.06b in receivables that were due within 12 months. So its liabilities total ₹3.16b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the ₹1.10b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Aksh Optifibre would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is Aksh Optifibre's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Aksh Optifibre made a loss at the EBIT level, and saw its revenue drop to ₹2.7b, which is a fall of 15%. That's not what we would hope to see.

Caveat Emptor

Not only did Aksh Optifibre's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost ₹68m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it lost ₹3.5b in just last twelve months, and it doesn't have much by way of liquid assets. So while it's not wise to assume the company will fail, we do think it's risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Aksh Optifibre you should be aware of, and 1 of them is a bit unpleasant.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Aksh Optifibre or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AKSHOPTFBR

Aksh Optifibre

Designs, manufactures, and sells optical fiber cables in India and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion