Xelpmoc Design and Tech (NSE:XELPMOC) delivers shareholders fantastic 63% CAGR over 3 years, surging 12% in the last week alone

It hasn't been the best quarter for Xelpmoc Design and Tech Limited (NSE:XELPMOC) shareholders, since the share price has fallen 26% in that time. But over three years the performance has been really wonderful. The longer term view reveals that the share price is up 331% in that period. Arguably, the recent fall is to be expected after such a strong rise. The thing to consider is whether there is still too much elation around the company's prospects.

Since the stock has added ₹473m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Xelpmoc Design and Tech

Xelpmoc Design and Tech wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Xelpmoc Design and Tech saw its revenue grow at 29% per year. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 63% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Xelpmoc Design and Tech can sometimes sustain strong growth for many years. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

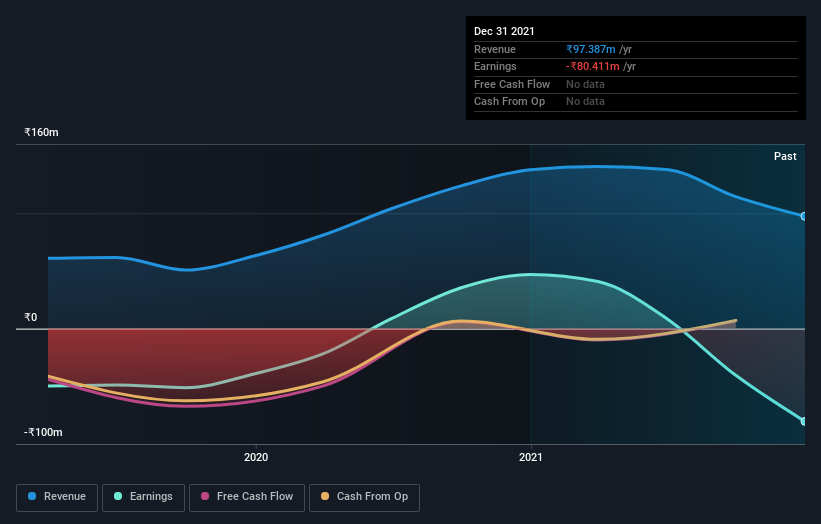

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Xelpmoc Design and Tech's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Xelpmoc Design and Tech produced a TSR of 8.4% over the last year. It's always nice to make money but this return falls short of the market return which was about 26% for the year. At least the longer term returns (running at about 63% a year, are better. We prefer focus on longer term returns, as they are usually a more meaningful indication of the underlying business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Xelpmoc Design and Tech that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:XELPMOC

Xelpmoc Design and Tech

Provides technical and expert consulting services to corporates, startups, and the government in India and internationally.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion