Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

SoftTech Engineers Limited (NSE:SOFTTECH) is a stock with outstanding fundamental characteristics. When we build an investment case, we need to look at the stock with a holistic perspective. In the case of SOFTTECH, it is a company with great financial health as well as a a strong track record of performance. Below is a brief commentary on these key aspects. For those interested in digger a bit deeper into my commentary, read the full report on SoftTech Engineers here.

Flawless balance sheet with solid track record

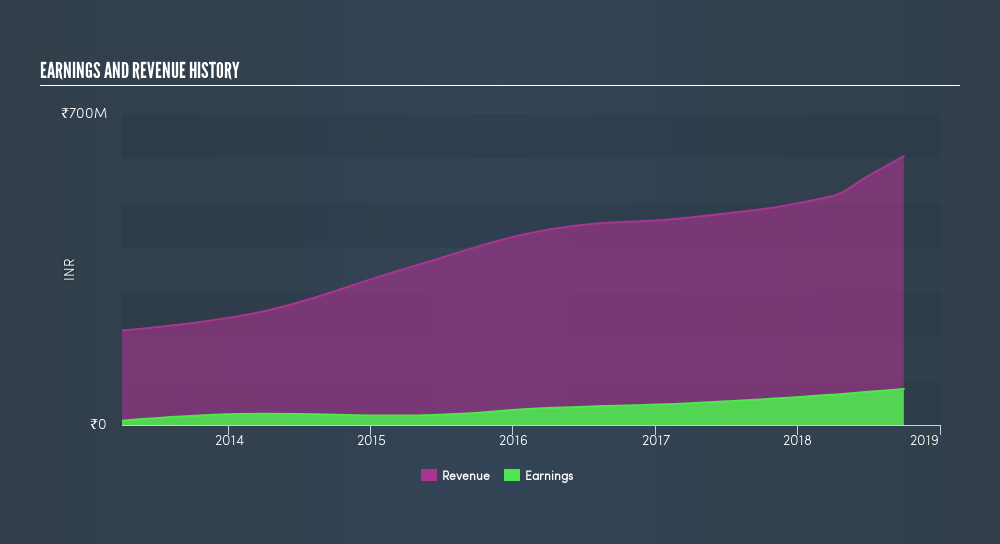

In the previous year, SOFTTECH has ramped up its bottom line by 39%, with its latest earnings level surpassing its average level over the last five years. In addition to beating its historical values, SOFTTECH also outperformed its industry, which delivered a growth of 21%. This paints a buoyant picture for the company. SOFTTECH is financially robust, with ample cash on hand and short-term investments to meet upcoming liabilities. This implies that SOFTTECH manages its cash and cost levels well, which is a key determinant of the company’s health. SOFTTECH appears to have made good use of debt, producing operating cash levels of 0.95x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated.

Next Steps:

For SoftTech Engineers, there are three fundamental factors you should look at:

- Future Outlook: What are well-informed industry analysts predicting for SOFTTECH’s future growth? Take a look at our free research report of analyst consensus for SOFTTECH’s outlook.

- Valuation: What is SOFTTECH worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether SOFTTECH is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of SOFTTECH? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SOFTTECH

SoftTech Engineers

Develops software products and solutions for the architecture, engineering, operations, and construction sectors in India and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.