It Looks Like Shareholders Would Probably Approve Newgen Software Technologies Limited's (NSE:NEWGEN) CEO Compensation Package

The performance at Newgen Software Technologies Limited (NSE:NEWGEN) has been quite strong recently and CEO Diwakar Nigam has played a role in it. Coming up to the next AGM on 27 July 2021, shareholders would be keeping this in mind. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Newgen Software Technologies

Comparing Newgen Software Technologies Limited's CEO Compensation With the industry

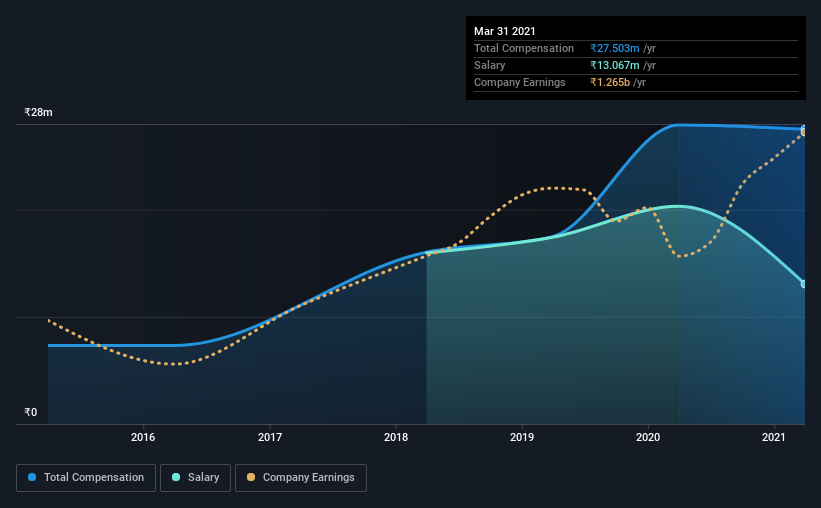

Our data indicates that Newgen Software Technologies Limited has a market capitalization of ₹46b, and total annual CEO compensation was reported as ₹28m for the year to March 2021. That's mostly flat as compared to the prior year's compensation. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹13m.

On examining similar-sized companies in the industry with market capitalizations between ₹30b and ₹120b, we discovered that the median CEO total compensation of that group was ₹37m. So it looks like Newgen Software Technologies compensates Diwakar Nigam in line with the median for the industry. Moreover, Diwakar Nigam also holds ₹10b worth of Newgen Software Technologies stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹13m | ₹20m | 48% |

| Other | ₹14m | ₹7.6m | 52% |

| Total Compensation | ₹28m | ₹28m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. In Newgen Software Technologies' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Newgen Software Technologies Limited's Growth Numbers

Newgen Software Technologies Limited's earnings per share (EPS) grew 17% per year over the last three years. Its revenue is up 1.8% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Newgen Software Technologies Limited Been A Good Investment?

Most shareholders would probably be pleased with Newgen Software Technologies Limited for providing a total return of 187% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for Newgen Software Technologies that investors should look into moving forward.

Switching gears from Newgen Software Technologies, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Newgen Software Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Newgen Software Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NEWGEN

Newgen Software Technologies

A software company, provides software products and solutions in India, Europe, the Middle East, Africa, the Asia Pacific, Australia, and the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives