In the last week, the Indian market has been flat, but it has risen 41% in the past 12 months with earnings forecasted to grow by 17% annually. In this context, identifying high growth tech stocks that can capitalize on these robust market conditions is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Sonata Software | 13.29% | 29.79% | ★★★★★☆ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.12% | 41.74% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coforge Limited offers IT and IT-enabled services across multiple regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific, with a market cap of ₹456.26 billion.

Operations: Coforge Limited generates revenue primarily through its Software Solutions segment, which reported earnings of ₹93.59 billion. The company operates across various regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific.

Coforge's strategic collaboration with Salesforce to launch Coforge ENZO, an environmental and net-zero offering, highlights its commitment to sustainability and innovation. The company’s earnings are forecasted to grow 22.5% annually, outpacing the Indian market's 17.1%. Despite a slight dip in net income from ₹1.65 billion to ₹1.33 billion year-over-year, R&D expenses have been robustly managed, ensuring continued advancements in their tech solutions. This focus on high-quality earnings through innovative projects positions Coforge strongly within the competitive tech landscape in India.

- Take a closer look at Coforge's potential here in our health report.

Explore historical data to track Coforge's performance over time in our Past section.

KPIT Technologies (NSEI:KPITTECH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KPIT Technologies Limited offers embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector across various global regions, with a market cap of ₹476.35 billion.

Operations: KPIT Technologies Limited specializes in providing embedded software, artificial intelligence, and digital solutions to the automobile and mobility sectors across various global markets. The company's revenue streams are primarily derived from these specialized services offered internationally.

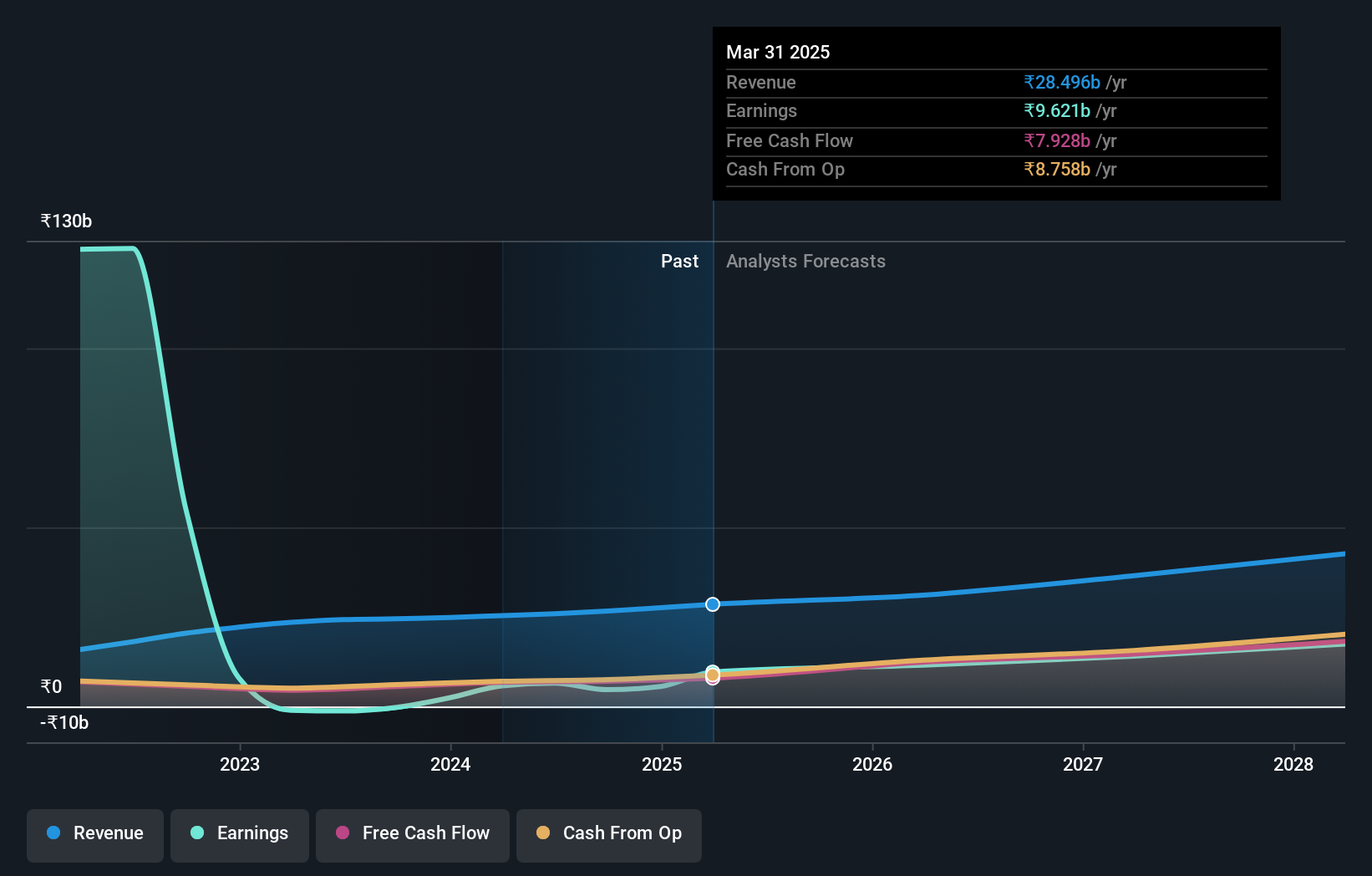

KPIT Technologies' revenue is projected to grow at 16.1% annually, surpassing the Indian market's 10.1%. Their earnings growth of 54.7% over the past year outpaced the software industry's 32.4%, highlighting robust performance. The company's R&D expenses have been significant, contributing to advancements in automotive middleware through its joint venture with ZF Friedrichshafen AG, which saw a EUR 1.35 million equity infusion and an additional EUR 13.65 million towards share premium from ZF for Qorix GmbH, enhancing their technological capabilities in mobility solutions.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in recruitment, matrimony, real estate, and education services in India and internationally, with a market cap of ₹965.44 billion.

Operations: The company generates revenue primarily from its recruitment solutions and real estate platform, 99acres, with recruitment solutions contributing ₹19.05 billion and real estate services adding ₹3.67 billion.

Info Edge (India) has shown impressive growth with revenue increasing to ₹8.28 billion from ₹6.90 billion year-over-year, while net income surged to ₹2.33 billion from ₹1.59 billion. The company’s earnings are expected to grow at 23.61% annually, outpacing the Indian market's 17.1%. Notably, their R&D expenses have been significant in driving innovation across their platforms, contributing to a forecasted revenue growth of 13% per year compared to the broader market's 10.1%.

- Delve into the full analysis health report here for a deeper understanding of Info Edge (India).

Examine Info Edge (India)'s past performance report to understand how it has performed in the past.

Taking Advantage

- Delve into our full catalog of 38 Indian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade KPIT Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KPIT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KPITTECH

KPIT Technologies

Provides embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector in the Americas, the United Kingdom, Europe, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives