If You Like EPS Growth Then Check Out Infosys (NSE:INFY) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Infosys (NSE:INFY). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Infosys

How Quickly Is Infosys Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Infosys has grown EPS by 5.8% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

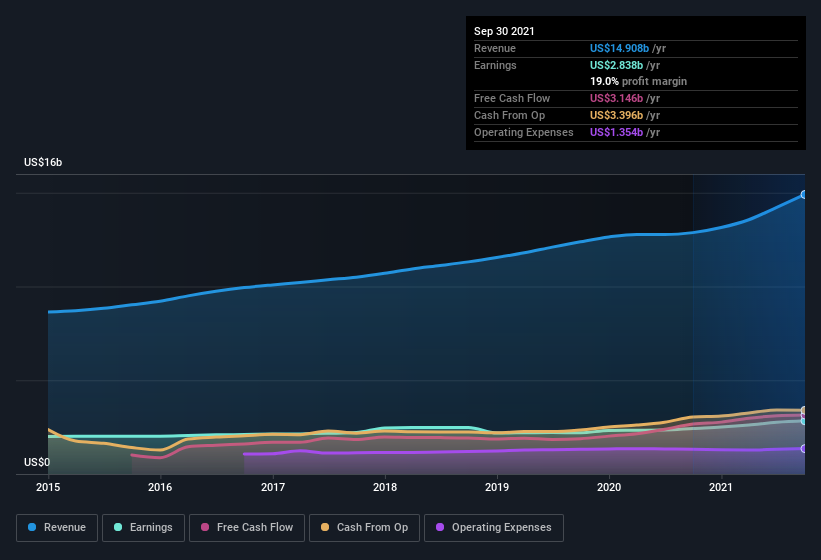

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Infosys maintained stable EBIT margins over the last year, all while growing revenue 16% to US$15b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Infosys's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Infosys Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -US$2.6b worth of shares. But that's far less than the US$3.1b insiders spend purchasing stock. This makes me even more interested in Infosys because it suggests that those who understand the company best, are optimistic. We also note that it was the Co-Founder & Chairman, Nandan Nilekani, who made the biggest single acquisition, paying ₹1.0b for shares at about ₹1,346 each.

Along with the insider buying, another encouraging sign for Infosys is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth US$943b. That equates to 13% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Should You Add Infosys To Your Watchlist?

One important encouraging feature of Infosys is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Still, you should learn about the 2 warning signs we've spotted with Infosys .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Infosys, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:INFY

Infosys

Provides consulting, technology, outsourcing, and next-generation digital services in North America, Europe, India, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives