Investors Appear Satisfied With Genesys International Corporation Limited's (NSE:GENESYS) Prospects As Shares Rocket 25%

Genesys International Corporation Limited (NSE:GENESYS) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last month tops off a massive increase of 145% in the last year.

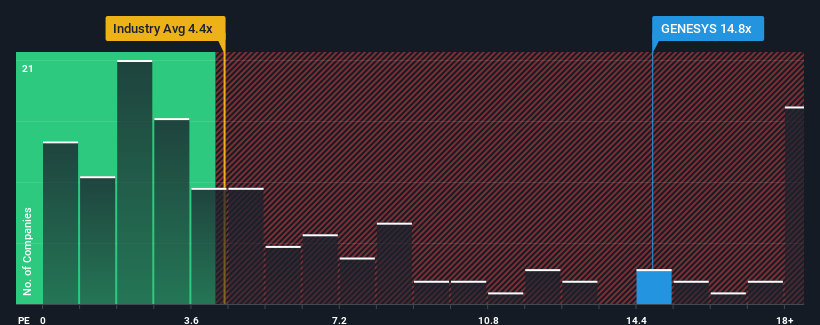

Following the firm bounce in price, Genesys International may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 14.8x, since almost half of all companies in the IT industry in India have P/S ratios under 4.4x and even P/S lower than 2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Genesys International

How Has Genesys International Performed Recently?

Genesys International certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Genesys International's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Genesys International's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 53% gain to the company's top line. Pleasingly, revenue has also lifted 159% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 8.0%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Genesys International's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

The strong share price surge has lead to Genesys International's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Genesys International maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Genesys International (including 1 which is a bit unpleasant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GENESYS

Genesys International

Provides geographical information services in India and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives