Investors Appear Satisfied With E2E Networks Limited's (NSE:E2E) Prospects As Shares Rocket 27%

E2E Networks Limited (NSE:E2E) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days were the cherry on top of the stock's 677% gain in the last year, which is nothing short of spectacular.

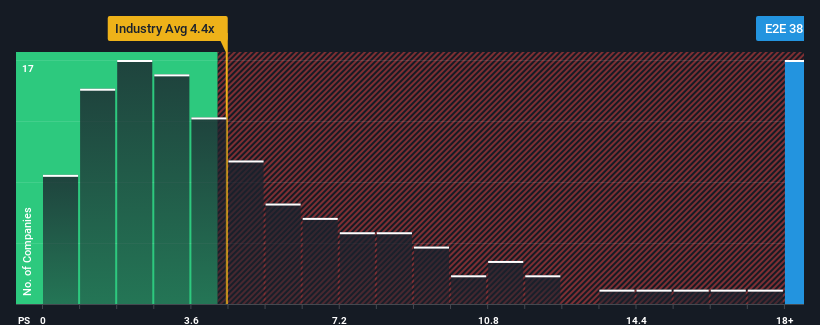

After such a large jump in price, E2E Networks may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 38.8x, when you consider almost half of the companies in the IT industry in India have P/S ratios under 4.4x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for E2E Networks

What Does E2E Networks' Recent Performance Look Like?

Recent times have been quite advantageous for E2E Networks as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for E2E Networks, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For E2E Networks?

E2E Networks' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 65%. The strong recent performance means it was also able to grow revenue by 198% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 7.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why E2E Networks' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On E2E Networks' P/S

E2E Networks' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of E2E Networks revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

We don't want to rain on the parade too much, but we did also find 2 warning signs for E2E Networks that you need to be mindful of.

If these risks are making you reconsider your opinion on E2E Networks, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if E2E Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:E2E

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion