Why Investors Shouldn't Be Surprised By Black Box Limited's (NSE:BBOX) 26% Share Price Surge

Black Box Limited (NSE:BBOX) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

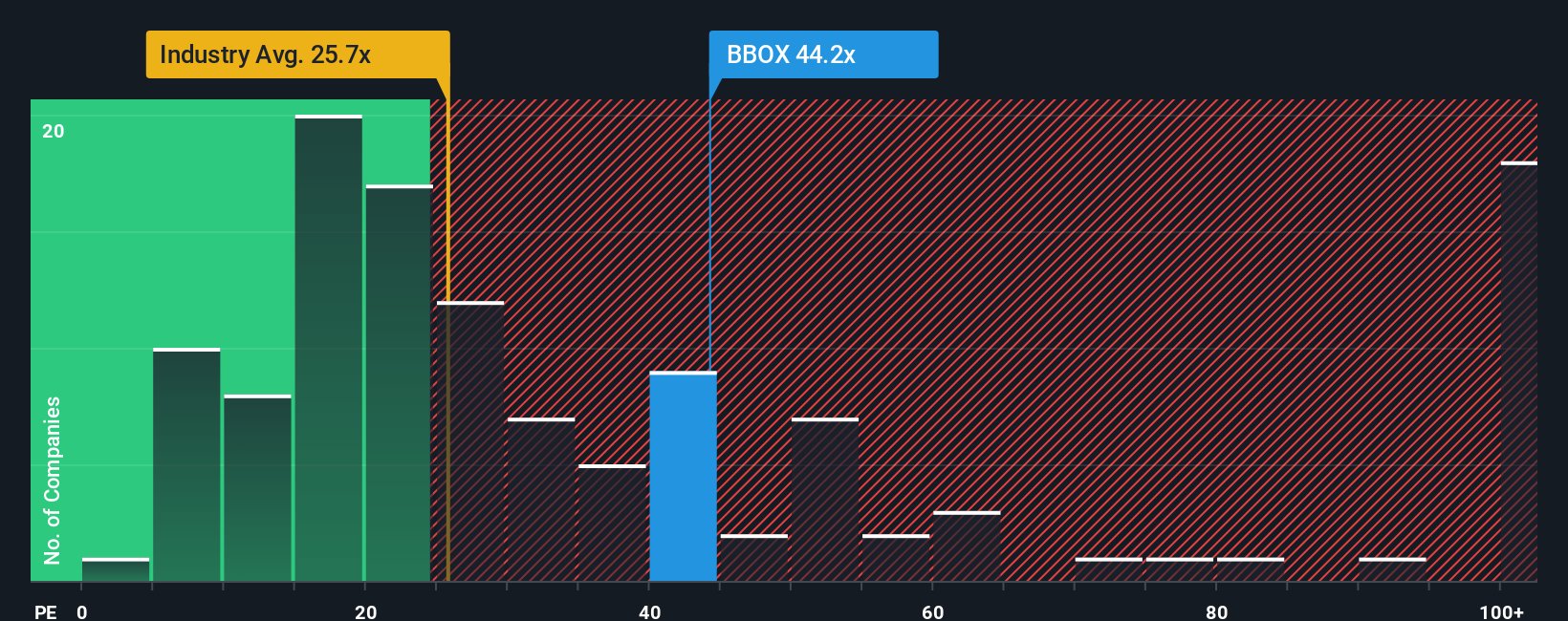

Since its price has surged higher, Black Box's price-to-earnings (or "P/E") ratio of 44.2x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 28x and even P/E's below 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Black Box certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Black Box

Is There Enough Growth For Black Box?

In order to justify its P/E ratio, Black Box would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 42% gain to the company's bottom line. Pleasingly, EPS has also lifted 264% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 28% per annum over the next three years. With the market only predicted to deliver 19% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Black Box's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Black Box's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Black Box maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Black Box (1 is concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Black Box might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BBOX

Black Box

Provides information and communications technology solutions in India, the United States, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)