If You Like EPS Growth Then Check Out 3i Infotech (NSE:3IINFOLTD) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like 3i Infotech (NSE:3IINFOLTD), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for 3i Infotech

How Fast Is 3i Infotech Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that 3i Infotech grew its EPS from ₹4.99 to ₹15.31, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that 3i Infotech's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. To cut to the chase 3i Infotech's EBIT margins dropped last year, and so did its revenue. That will not make it easy to grow profits, to say the least.

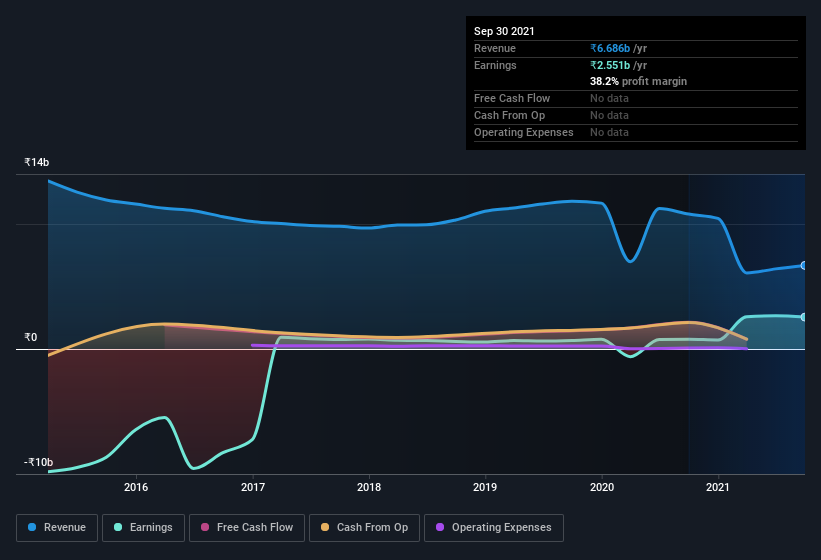

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since 3i Infotech is no giant, with a market capitalization of ₹14b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are 3i Infotech Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx 3i Infotech insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the ₹5.5m that Pravir Vohra spent buying shares (at an average price of about ₹109).

It's reassuring that 3i Infotech insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like 3i Infotech with market caps between ₹7.4b and ₹30b is about ₹13m.

The 3i Infotech CEO received total compensation of only ₹459k in the year to . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does 3i Infotech Deserve A Spot On Your Watchlist?

3i Infotech's earnings have taken off like any random crypto-currency did, back in 2017. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that 3i Infotech is at an inflection point, given the EPS growth. For those chasing fast growth, then, I'd suggest to stock merits monitoring. Still, you should learn about the 3 warning signs we've spotted with 3i Infotech .

The good news is that 3i Infotech is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if 3i Infotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:3IINFOLTD

3i Infotech

Provides IP based software solutions in India, the United States, the United Kingdom, the Middle East, Africa, South Asia, the Asia Pacific, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026