- India

- /

- Semiconductors

- /

- NSEI:SOLEX

Further Upside For Solex Energy Limited (NSE:SOLEX) Shares Could Introduce Price Risks After 30% Bounce

Solex Energy Limited (NSE:SOLEX) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 278% in the last year.

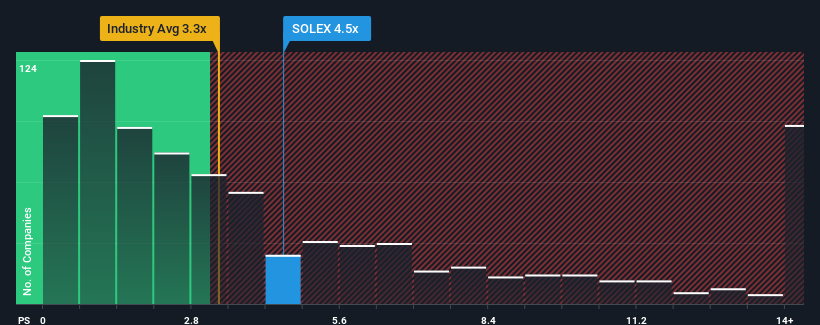

Even after such a large jump in price, Solex Energy's price-to-sales (or "P/S") ratio of 4.5x might still make it look like a strong buy right now compared to the wider Semiconductor industry in India, where around half of the companies have P/S ratios above 10.7x and even P/S above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Solex Energy

What Does Solex Energy's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Solex Energy has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Solex Energy will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Solex Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 126% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 30%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Solex Energy's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Even after such a strong price move, Solex Energy's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Solex Energy currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Solex Energy (of which 2 are a bit concerning!) you should know about.

If you're unsure about the strength of Solex Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOLEX

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives