- India

- /

- Semiconductors

- /

- NSEI:APS

Earnings Tell The Story For Australian Premium Solar (India) Limited (NSE:APS) As Its Stock Soars 28%

Australian Premium Solar (India) Limited (NSE:APS) shareholders have had their patience rewarded with a 28% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

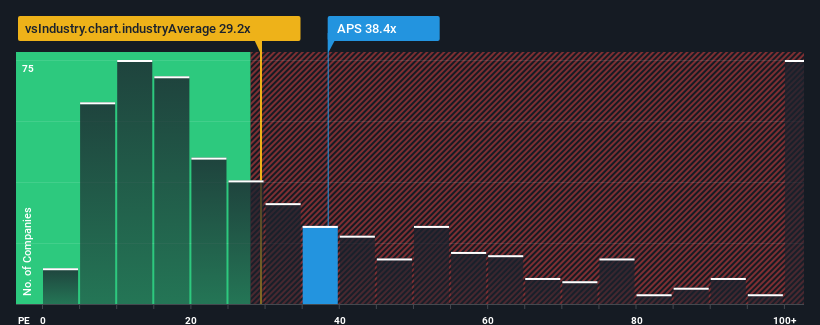

Since its price has surged higher, Australian Premium Solar (India) may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 38.4x, since almost half of all companies in India have P/E ratios under 27x and even P/E's lower than 15x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's exceedingly strong of late, Australian Premium Solar (India) has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Australian Premium Solar (India)

Is There Enough Growth For Australian Premium Solar (India)?

There's an inherent assumption that a company should outperform the market for P/E ratios like Australian Premium Solar (India)'s to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 353% last year. The strong recent performance means it was also able to grow EPS by 609% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Australian Premium Solar (India) is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Australian Premium Solar (India) shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Australian Premium Solar (India) revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Australian Premium Solar (India) that you need to be mindful of.

If you're unsure about the strength of Australian Premium Solar (India)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:APS

Australian Premium Solar (India)

Manufactures and sells monocrystalline and polycrystalline solar panels in India.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives