- India

- /

- Specialty Stores

- /

- NSEI:SENCO

Top Growth Companies With High Insider Ownership On Indian Exchanges September 2024

Reviewed by Simply Wall St

The Indian market has climbed 1.3% over the last week and is up 45% over the last 12 months, with earnings forecast to grow by 17% annually. In this thriving environment, identifying growth companies with high insider ownership can be a strategic move, as it often signals confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.6% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| KEI Industries (BSE:517569) | 18.7% | 22.4% |

Here's a peek at a few of the choices from the screener.

Astral (NSEI:ASTRAL)

Simply Wall St Growth Rating: ★★★★★☆

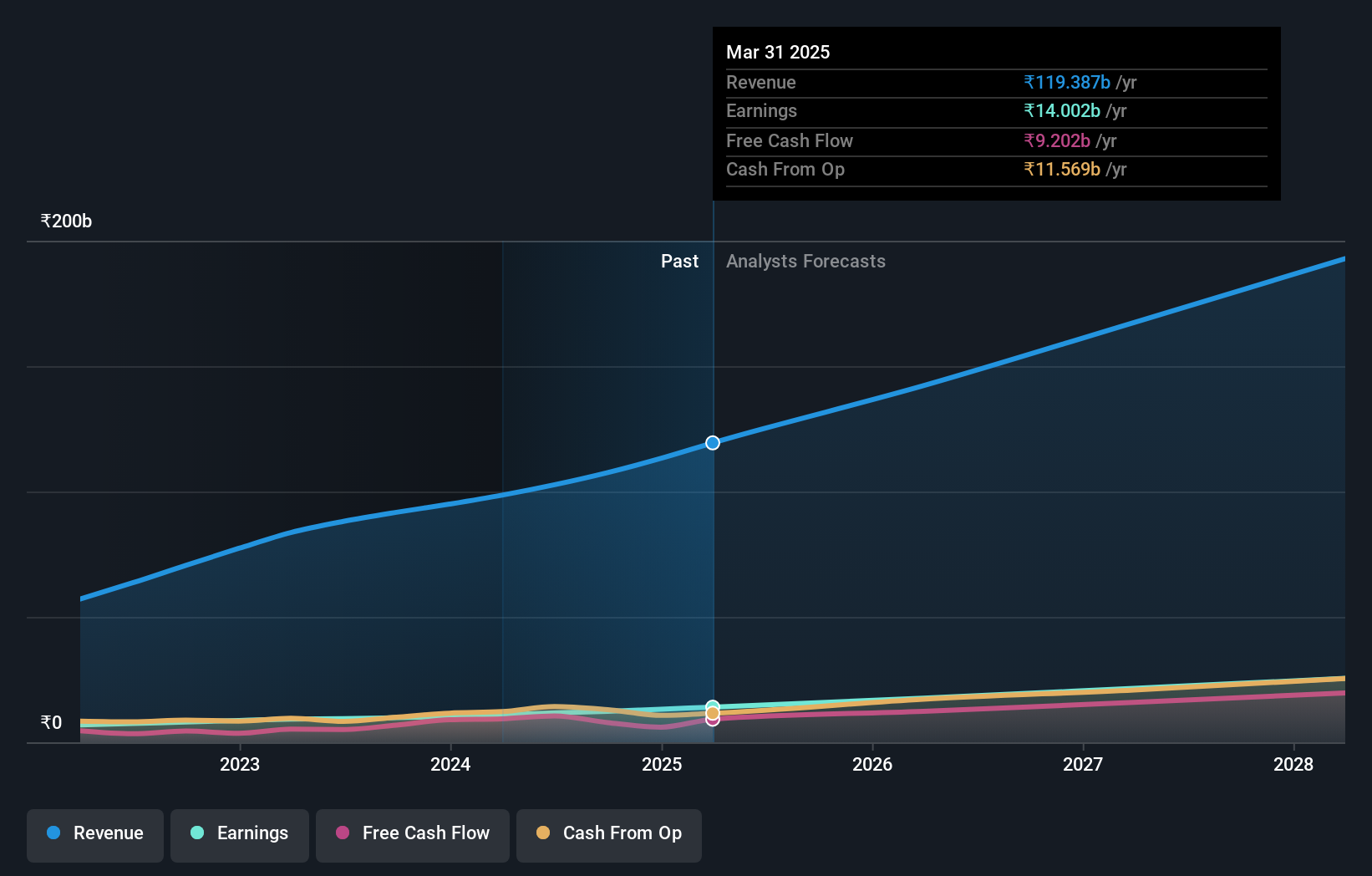

Overview: Astral Limited, with a market cap of ₹538.56 billion, manufactures and markets pipes, water tanks, adhesives, and sealants in India and internationally through its subsidiaries.

Operations: The company's revenue segments include ₹42.17 billion from plumbing and ₹15.25 billion from paints and adhesives.

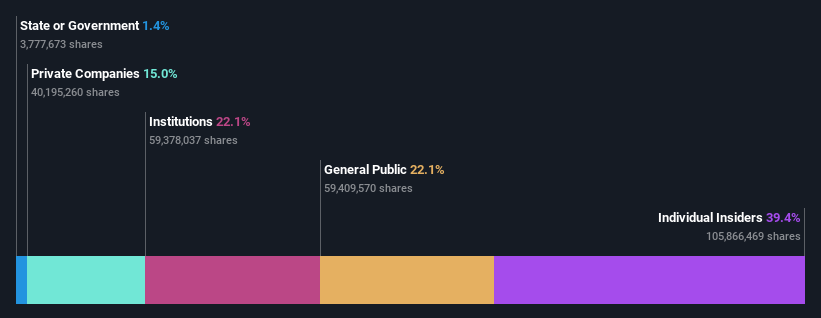

Insider Ownership: 39.4%

Astral Limited, a growth company with high insider ownership, has shown consistent earnings growth of 17.7% annually over the past five years and is forecasted to grow its earnings by 23.53% per year, outpacing the Indian market's expected growth. Recent expansions include commissioning a new plant in Hyderabad and consolidating manufacturing operations to improve efficiency. Despite these positive developments, revenue growth is projected at 17.3% annually, slightly below the 20% benchmark for high-growth companies.

- Take a closer look at Astral's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Astral's current price could be inflated.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited offers software products, services, and technology solutions across India, North America, and internationally with a market cap of ₹798.70 billion.

Operations: The company's revenue segments include Healthcare & Life Sciences (₹23.88 billion), Software, Hi-Tech and Emerging Industries (₹46.41 billion), and Banking, Financial Services and Insurance (BFSI) (₹32.08 billion).

Insider Ownership: 34.3%

Persistent Systems is forecasted to grow its revenue by 13.7% annually, outpacing the Indian market's 10.1%, though not reaching the high-growth benchmark of 20%. Earnings are expected to rise by 19.4% per year, exceeding the market average of 17.2%. Recent executive changes include appointing Sachin Pathak as Chief Risk Officer and a strategic partnership with Mage Data™ to enhance data security services, which could bolster Persistent’s growth trajectory despite moderate insider ownership activity recently.

- Click to explore a detailed breakdown of our findings in Persistent Systems' earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Persistent Systems shares in the market.

Senco Gold (NSEI:SENCO)

Simply Wall St Growth Rating: ★★★★☆☆

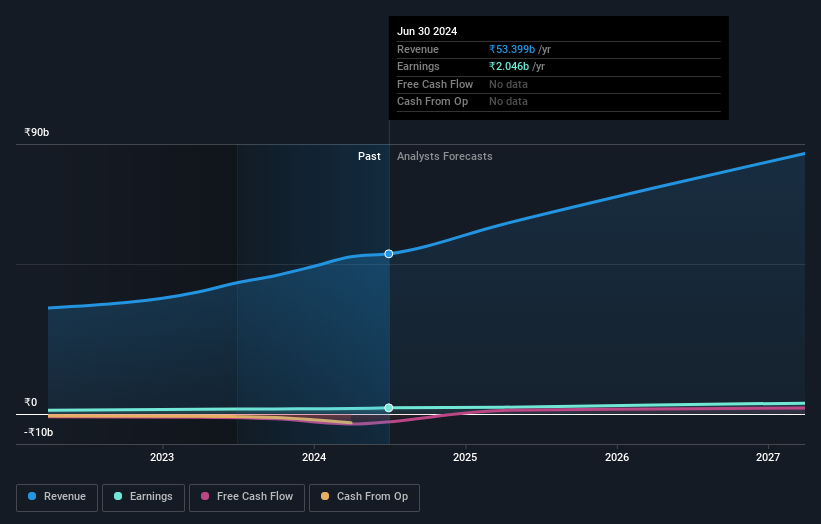

Overview: Senco Gold Limited manufactures and trades jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India, with a market cap of ₹113.81 billion.

Operations: The company's revenue primarily comes from its jewelry business, which generated ₹53.40 billion.

Insider Ownership: 24.1%

Senco Gold, recently added to the S&P Global BMI Index, has shown robust growth with its earnings increasing by 25.1% over the past year. Despite forecasted revenue growth of 17.5% annually—slower than the high-growth benchmark—it still surpasses the Indian market average of 10.1%. The company’s earnings are expected to grow significantly at 21.8% per year over the next three years, outpacing market expectations. Recent expansions include incorporating a wholly-owned subsidiary, SENNES FASHION LIMITED.

- Click here to discover the nuances of Senco Gold with our detailed analytical future growth report.

- The analysis detailed in our Senco Gold valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Investigate our full lineup of 94 Fast Growing Indian Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Senco Gold, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SENCO

Senco Gold

Engages in the manufacture and trading of jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives