- India

- /

- Specialty Stores

- /

- NSEI:NYKAA

FSN E-Commerce Ventures Limited (NSE:NYKAA) Not Flying Under The Radar

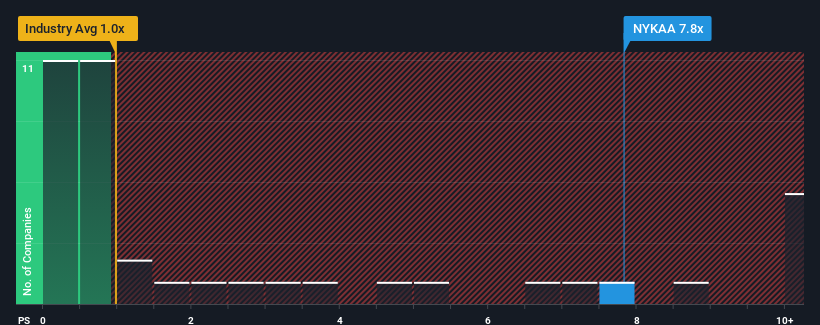

FSN E-Commerce Ventures Limited's (NSE:NYKAA) price-to-sales (or "P/S") ratio of 7.8x may look like a poor investment opportunity when you consider close to half the companies in the Specialty Retail industry in India have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for FSN E-Commerce Ventures

What Does FSN E-Commerce Ventures' P/S Mean For Shareholders?

Recent times haven't been great for FSN E-Commerce Ventures as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on FSN E-Commerce Ventures will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For FSN E-Commerce Ventures?

In order to justify its P/S ratio, FSN E-Commerce Ventures would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 36% last year. The latest three year period has also seen an excellent 191% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 28% per annum as estimated by the analysts watching the company. That's shaping up to be materially higher than the 25% each year growth forecast for the broader industry.

With this information, we can see why FSN E-Commerce Ventures is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On FSN E-Commerce Ventures' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that FSN E-Commerce Ventures maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Specialty Retail industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for FSN E-Commerce Ventures (1 doesn't sit too well with us!) that you should be aware of.

If these risks are making you reconsider your opinion on FSN E-Commerce Ventures, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NYKAA

FSN E-Commerce Ventures

Through its subsidiaries, provides a range of beauty, personal care, and fashion products for women, men, kids, and home in India and internationally.

Exceptional growth potential with solid track record.