- India

- /

- Food and Staples Retail

- /

- NSEI:FRETAIL

Future Retail's(NSE:FRETAIL) Share Price Is Down 87% Over The Past Three Years.

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Future Retail Limited (NSE:FRETAIL) investors who have held the stock for three years as it declined a whopping 87%. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 74% in the last year. The falls have accelerated recently, with the share price down 13% in the last three months.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Future Retail

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

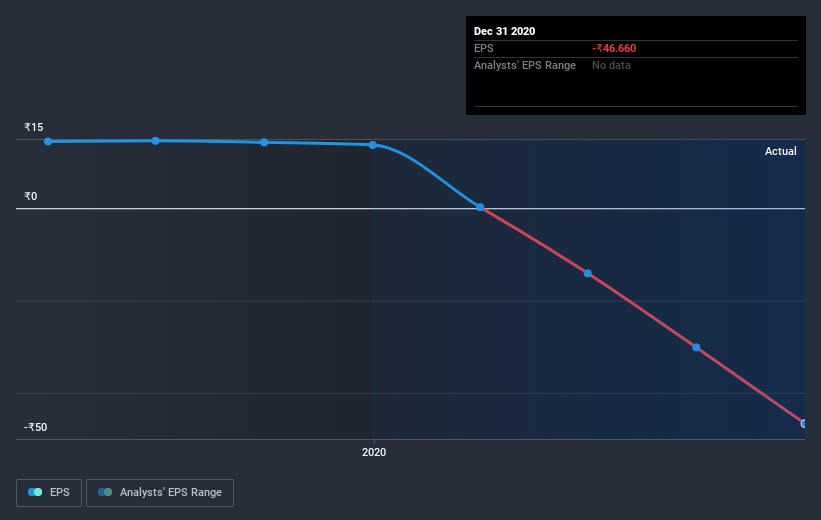

Future Retail saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Future Retail's key metrics by checking this interactive graph of Future Retail's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Future Retail shares, which cost holders 74%, while the market was up about 51%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 23% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Future Retail (including 2 which can't be ignored) .

Of course Future Retail may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Future Retail, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:FRETAIL

Future Retail

Engages in retailing fashion, household, food, and consumer products in India.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives