- India

- /

- Real Estate

- /

- NSEI:LPDC

I Built A List Of Growing Companies And Landmark Property Development (NSE:LPDC) Made The Cut

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Landmark Property Development (NSE:LPDC), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Landmark Property Development

Landmark Property Development's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. We can see that in the last three years Landmark Property Development grew its EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Landmark Property Development is growing revenues, and EBIT margins improved by 81.2 percentage points to -34%, over the last year. That's great to see, on both counts.

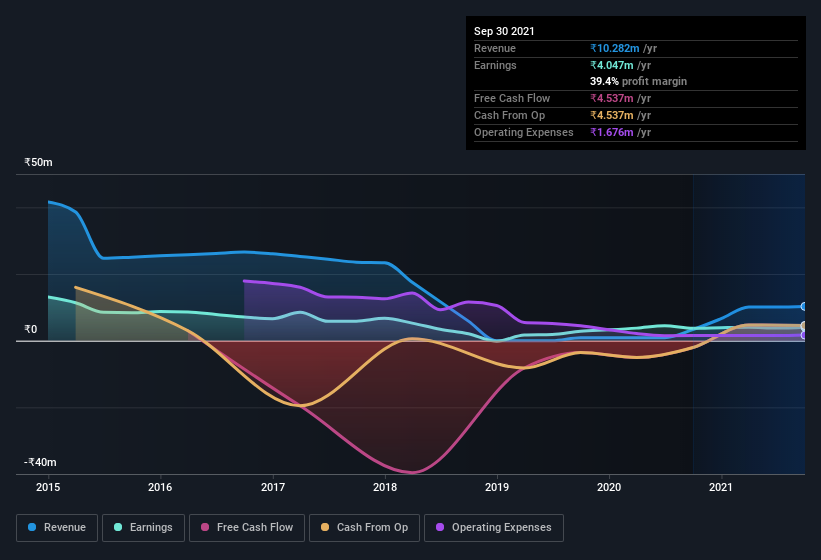

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Landmark Property Development isn't a huge company, given its market capitalization of ₹795m. That makes it extra important to check on its balance sheet strength.

Are Landmark Property Development Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Landmark Property Development insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 72%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, Landmark Property Development is a very small company, with a market cap of only ₹795m. So despite a large proportional holding, insiders only have ₹571m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Landmark Property Development To Your Watchlist?

As I already mentioned, Landmark Property Development is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. Don't forget that there may still be risks. For instance, we've identified 5 warning signs for Landmark Property Development (2 are significant) you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LPDC

Landmark Property Development

Engages in the real estate development business in India.

Flawless balance sheet slight.

Market Insights

Community Narratives