- India

- /

- Real Estate

- /

- NSEI:EMBDL

Have Indiabulls Real Estate Limited (NSE:IBREALEST) Insiders Been Selling Their Stock?

Investors may wish to note that the Joint MD & Director of Indiabulls Real Estate Limited, Gurbans Singh, recently netted ₹4.6m from selling stock, receiving an average price of ₹60.83. It might not be a huge sale, but it did reduce their holding size 24%, hardly encouraging.

Check out our latest analysis for Indiabulls Real Estate

Indiabulls Real Estate Insider Transactions Over The Last Year

In fact, the recent sale by Gurbans Singh was the biggest sale of Indiabulls Real Estate shares made by an insider individual in the last twelve months, according to our records. That means that even when the share price was below the current price of ₹64.75, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. We note that the biggest single sale was only 24%of Gurbans Singh's holding.

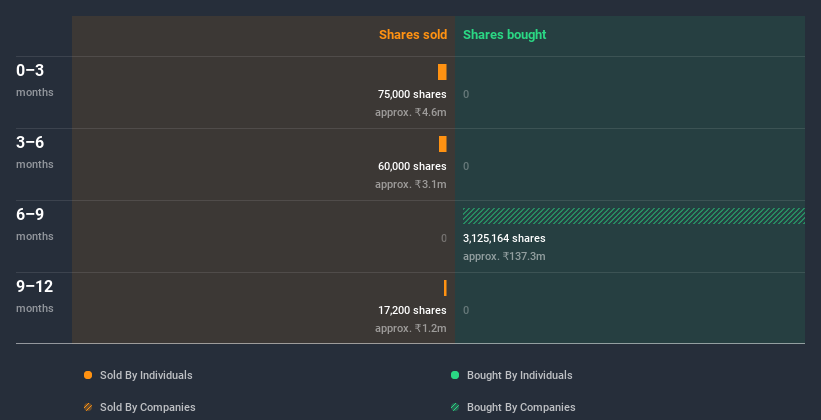

In the last year Indiabulls Real Estate insiders didn't buy any company stock. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Indiabulls Real Estate insiders own about ₹2.4b worth of shares. That equates to 8.2% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Indiabulls Real Estate Insiders?

An insider sold stock recently, but they haven't been buying. And even if we look at the last year, we didn't see any purchases. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Indiabulls Real Estate. In terms of investment risks, we've identified 2 warning signs with Indiabulls Real Estate and understanding these should be part of your investment process.

But note: Indiabulls Real Estate may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Indiabulls Real Estate, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Embassy Developments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:EMBDL

Adequate balance sheet low.