- India

- /

- Real Estate

- /

- NSEI:EMBDL

Does Indiabulls Real Estate's (NSE:IBREALEST) Share Price Gain of 97% Match Its Business Performance?

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Indiabulls Real Estate share price has climbed 97% in five years, easily topping the market return of 79% (ignoring dividends).

See our latest analysis for Indiabulls Real Estate

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

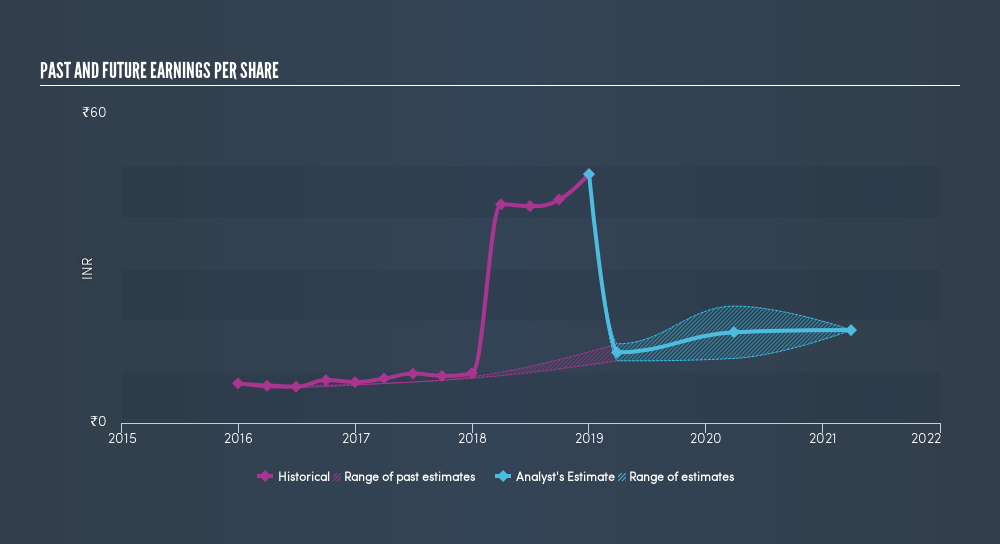

Over half a decade, Indiabulls Real Estate managed to grow its earnings per share at 54% a year. The EPS growth is more impressive than the yearly share price gain of 14% over the same period. So one could conclude that the broader market has become more cautious towards the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 1.98.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Indiabulls Real Estate has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Indiabulls Real Estate's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Indiabulls Real Estate's TSR of 100% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Indiabulls Real Estate shareholders are down 52% for the year, but the market itself is up 4.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 15%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research Indiabulls Real Estate in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:EMBDL

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives