- India

- /

- Office REITs

- /

- NSEI:EMBASSY

Here's Why We Think Embassy Office Parks REIT (NSE:EMBASSY) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Embassy Office Parks REIT (NSE:EMBASSY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Embassy Office Parks REIT

Embassy Office Parks REIT's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. Embassy Office Parks REIT's EPS has risen over the last 12 months, growing from ₹8.09 to ₹9.10. There's little doubt shareholders would be happy with that 12% gain.

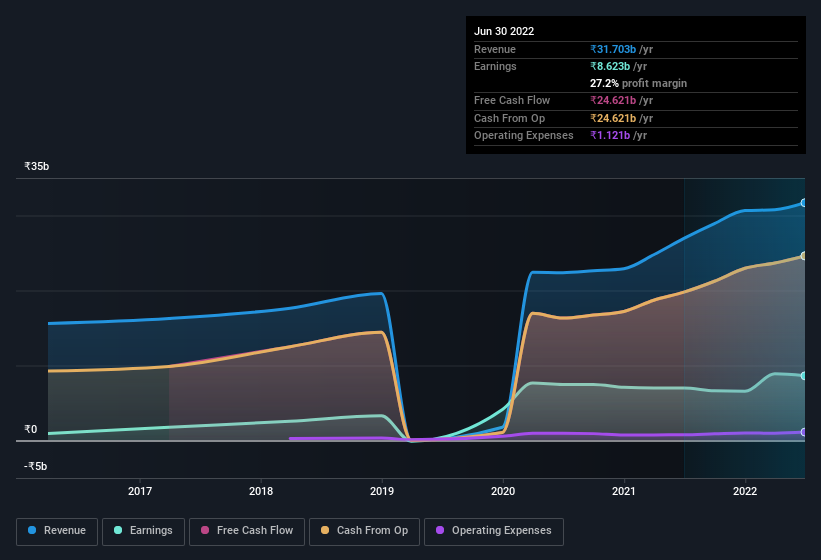

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Embassy Office Parks REIT's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. On the revenue front, Embassy Office Parks REIT has done well over the past year, growing revenue by 18% to ₹32b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Embassy Office Parks REIT's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Embassy Office Parks REIT Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Over the preceding 12 months, we see that company insiders sold ₹88m worth of Embassy Office Parks REIT stock. But the silver lining to that cloud is that Vikaash Khdloya, the CEO & COO of Embassy Office Parks Management Services Private Limited, spent ₹90m buying shares at an average price of ₹389. And that's a reason to be optimistic.

On top of the insider buying, it's good to see that Embassy Office Parks REIT insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹10b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Embassy Office Parks REIT Worth Keeping An Eye On?

One positive for Embassy Office Parks REIT is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. What about risks? Every company has them, and we've spotted 2 warning signs for Embassy Office Parks REIT (of which 1 can't be ignored!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Embassy Office Parks REIT, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Embassy Office Parks REIT, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Embassy Office Parks REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EMBASSY

Embassy Office Parks REIT

Owns, operates, and invests in real estate and related assets in India.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives