- India

- /

- Real Estate

- /

- NSEI:ASHIANA

Here's Why Ashiana Housing Limited's (NSE:ASHIANA) CEO Compensation Is The Least Of Shareholders' Concerns

The share price of Ashiana Housing Limited (NSE:ASHIANA) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. The upcoming AGM on 08 September 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Ashiana Housing

How Does Total Compensation For Ankur Gupta Compare With Other Companies In The Industry?

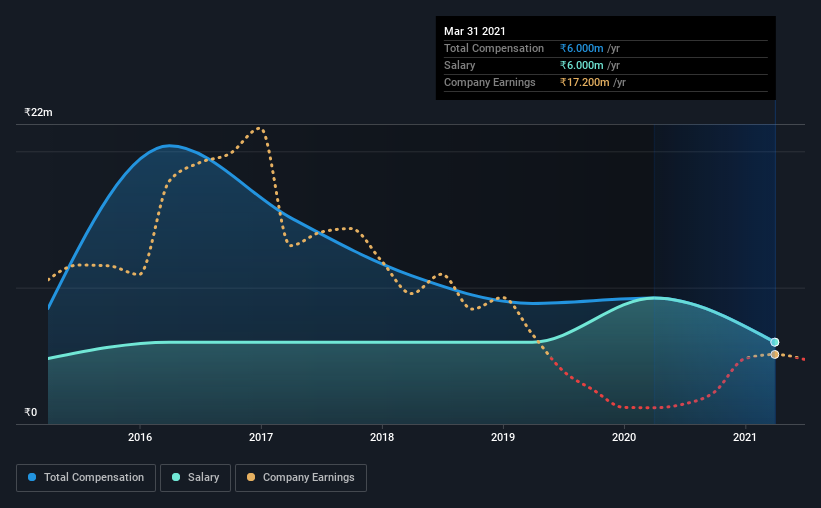

Our data indicates that Ashiana Housing Limited has a market capitalization of ₹17b, and total annual CEO compensation was reported as ₹6.0m for the year to March 2021. We note that's a decrease of 35% compared to last year. Notably, the salary of ₹6.0m is the entirety of the CEO compensation.

For comparison, other companies in the same industry with market capitalizations ranging between ₹7.3b and ₹29b had a median total CEO compensation of ₹5.3m. From this we gather that Ankur Gupta is paid around the median for CEOs in the industry. Furthermore, Ankur Gupta directly owns ₹3.3b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹6.0m | ₹9.2m | 100% |

| Other | - | - | - |

| Total Compensation | ₹6.0m | ₹9.2m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. At the company level, Ashiana Housing pays Ankur Gupta solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Ashiana Housing Limited's Growth

Over the last three years, Ashiana Housing Limited has shrunk its earnings per share by 80% per year. It saw its revenue drop 15% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Ashiana Housing Limited Been A Good Investment?

Ashiana Housing Limited has not done too badly by shareholders, with a total return of 8.4%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Ashiana Housing rewards its CEO solely through a salary, ignoring non-salary benefits completely. While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in Ashiana Housing we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Ashiana Housing, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ASHIANA

Ashiana Housing

Through its subsidiaries, engages in the real estate development business in India.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives