- India

- /

- Real Estate

- /

- NSEI:PURVA

Despite lower earnings than five years ago, Puravankara (NSE:PURVA) investors are up 519% since then

Puravankara Limited (NSE:PURVA) shareholders might be concerned after seeing the share price drop 11% in the last month. But over five years returns have been remarkably great. In that time, the share price has soared some 477% higher! Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term.

Although Puravankara has shed ₹7.6b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Puravankara

We don't think that Puravankara's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Puravankara can boast revenue growth at a rate of 3.0% per year. Put simply, that growth rate fails to impress. Therefore, we're a little surprised to see the share price gain has been so strong, at 42% per year, compound, over the period. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

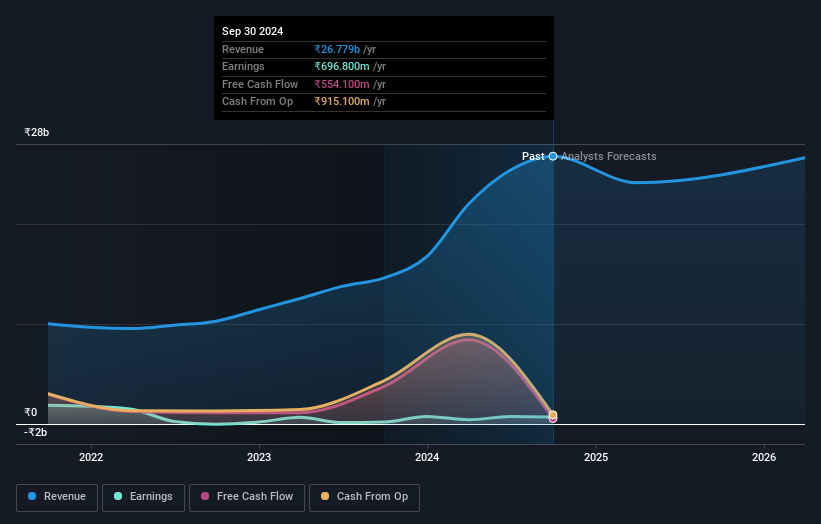

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Puravankara has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Puravankara

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Puravankara the TSR over the last 5 years was 519%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Puravankara shareholders have received a total shareholder return of 61% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 44%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Puravankara (at least 3 which are potentially serious) , and understanding them should be part of your investment process.

We will like Puravankara better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PURVA

Puravankara

Designs, develops, constructs, and markets residential and commercial properties in India.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives