Investors in Wockhardt (NSE:WOCKPHARMA) have seen massive returns of 469% over the past three years

While Wockhardt Limited (NSE:WOCKPHARMA) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 24% in the last quarter. But over the last three years the stock has shone bright like a diamond. Over that time, we've been excited to watch the share price climb an impressive 469%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. Only time will tell if there is still too much optimism currently reflected in the share price.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Wockhardt wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Wockhardt saw its revenue grow at 3.6% per year. That's not a very high growth rate considering it doesn't make profits. So we're surprised that the share price has soared by 79% each year over that time. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. The company will need to continue to execute on its business strategy to justify this rise.

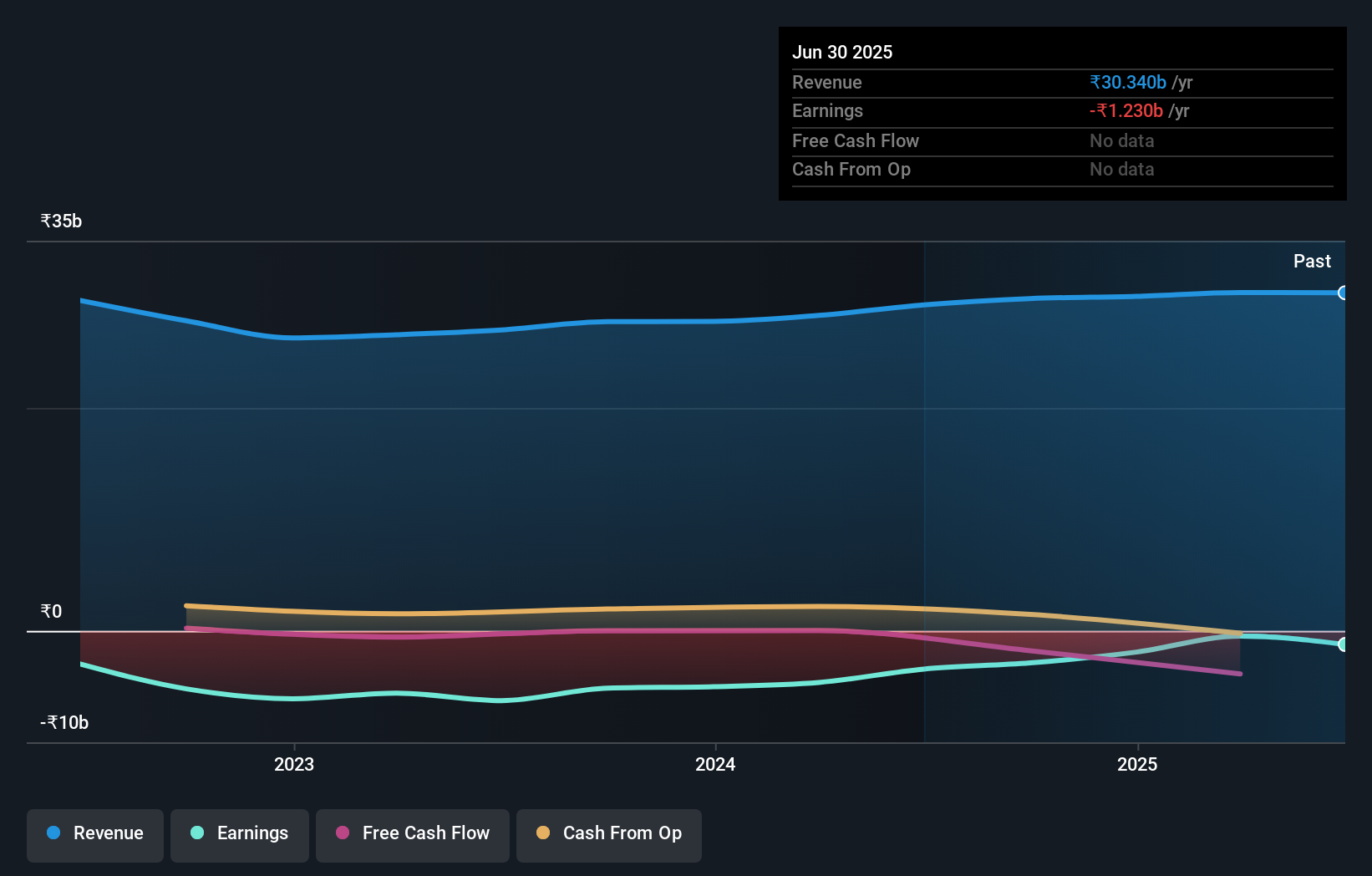

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Wockhardt has rewarded shareholders with a total shareholder return of 33% in the last twelve months. However, that falls short of the 38% TSR per annum it has made for shareholders, each year, over five years. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Wockhardt (of which 1 is potentially serious!) you should know about.

But note: Wockhardt may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wockhardt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WOCKPHARMA

Wockhardt

Operates as a pharmaceutical and biotech company, in India, the United States, the United Kingdom, Switzerland, Ireland, Russia, Europe, and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives