Investors Give Vaishali Pharma Limited (NSE:VAISHALI) Shares A 33% Hiding

Vaishali Pharma Limited (NSE:VAISHALI) shares have had a horrible month, losing 33% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 22% in the last year.

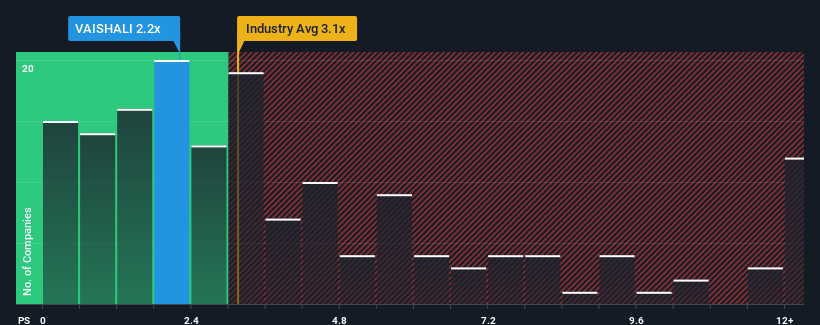

In spite of the heavy fall in price, Vaishali Pharma may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.2x, since almost half of all companies in the Pharmaceuticals industry in India have P/S ratios greater than 3.1x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Vaishali Pharma

How Has Vaishali Pharma Performed Recently?

The revenue growth achieved at Vaishali Pharma over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Vaishali Pharma will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Vaishali Pharma's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. The strong recent performance means it was also able to grow revenue by 56% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Vaishali Pharma is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Vaishali Pharma's P/S Mean For Investors?

Vaishali Pharma's recently weak share price has pulled its P/S back below other Pharmaceuticals companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Vaishali Pharma revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Having said that, be aware Vaishali Pharma is showing 4 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VAISHALI

Vaishali Pharma

Engages in the pharmaceutical business in India and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives