Is Now The Time To Put Themis Medicare (NSE:THEMISMED) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Themis Medicare (NSE:THEMISMED). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Themis Medicare

Themis Medicare's Improving Profits

In the last three years Themis Medicare's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Themis Medicare's EPS shot from ₹37.98 to ₹77.15, over the last year. You don't see 103% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

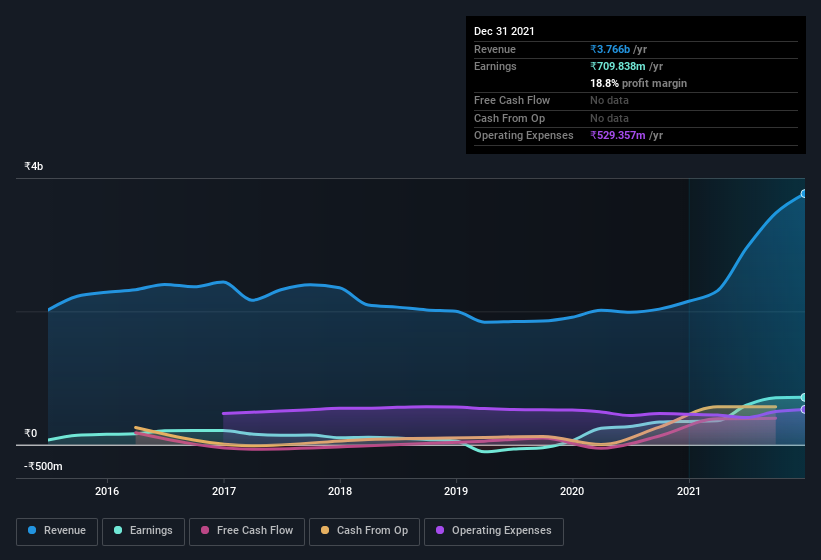

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Themis Medicare is growing revenues, and EBIT margins improved by 2.6 percentage points to 22%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Themis Medicare is no giant, with a market capitalization of ₹7.4b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Themis Medicare Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Themis Medicare insiders own a significant number of shares certainly appeals to me. Actually, with 37% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have ₹2.8b invested in the business, using the current share price. That's nothing to sneeze at!

Does Themis Medicare Deserve A Spot On Your Watchlist?

Themis Medicare's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind Themis Medicare is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Themis Medicare that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Themis Medicare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:THEMISMED

Themis Medicare

Manufactures and sells pharmaceutical products in India and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives