Over the last 7 days, the Indian market has experienced a 4.9% drop, yet it boasts an impressive 37% increase over the past year, with earnings projected to grow by 18% annually. In this dynamic environment, identifying promising small-cap stocks that exhibit strong growth potential and resilience can be key to uncovering hidden opportunities in India's vibrant market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Timex Group India | 2.15% | 19.46% | 58.41% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Kaycee Industries | 17.35% | 19.50% | 34.62% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Jammu and Kashmir Bank (NSEI:J&KBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Jammu and Kashmir Bank Limited offers a range of banking products and services, with a market capitalization of ₹107.51 billion.

Operations: J&K Bank generates revenue primarily through its banking products and services. The financial data provided does not include specific figures for revenue streams or cost breakdowns, limiting further analysis.

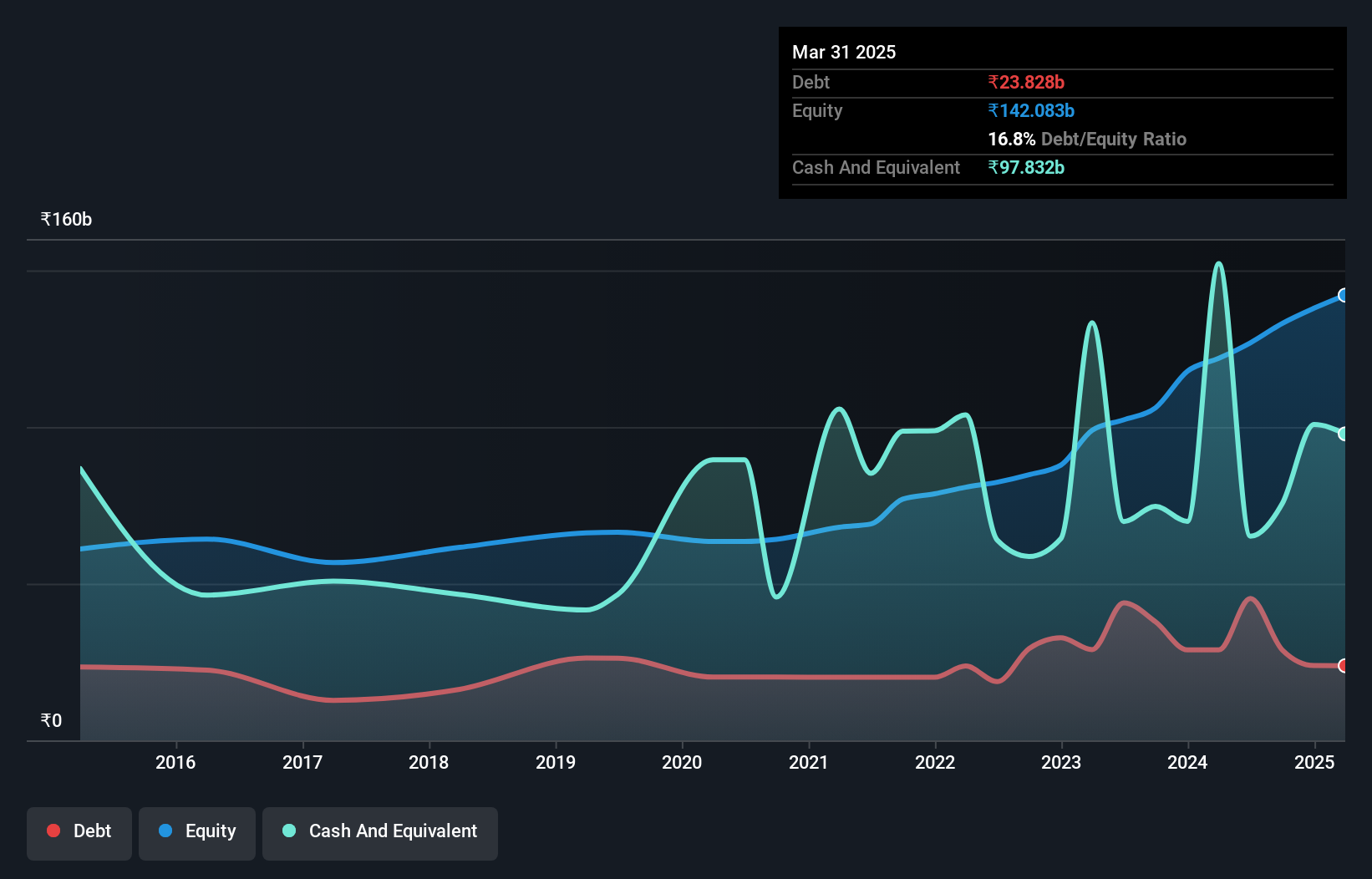

With total assets of ₹1,594.6 billion and equity at ₹133.1 billion, Jammu and Kashmir Bank stands out in the financial sector. Total deposits reach ₹1,379.1 billion while loans are at ₹961.2 billion with a net interest margin of 3.9%. Despite high earnings growth of 35.5% last year, the bank grapples with a significant bad loan ratio of 4.1%. Trading at a price-to-earnings ratio of 5.3x compared to the market's 31.6x suggests it offers good value relative to peers, though shareholders faced dilution over the past year due to strategic decisions likely impacting its capital structure.

- Navigate through the intricacies of Jammu and Kashmir Bank with our comprehensive health report here.

Evaluate Jammu and Kashmir Bank's historical performance by accessing our past performance report.

Nitin Spinners (NSEI:NITINSPIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nitin Spinners Limited manufactures and sells cotton and blended yarns, as well as knitted and woven fabrics, serving both domestic and international markets with a market cap of ₹21.05 billion.

Operations: Nitin Spinners generates revenue primarily from its textiles segment, amounting to ₹30.92 billion. The company operates in both domestic and international markets, focusing on cotton and blended yarns as well as knitted and woven fabrics.

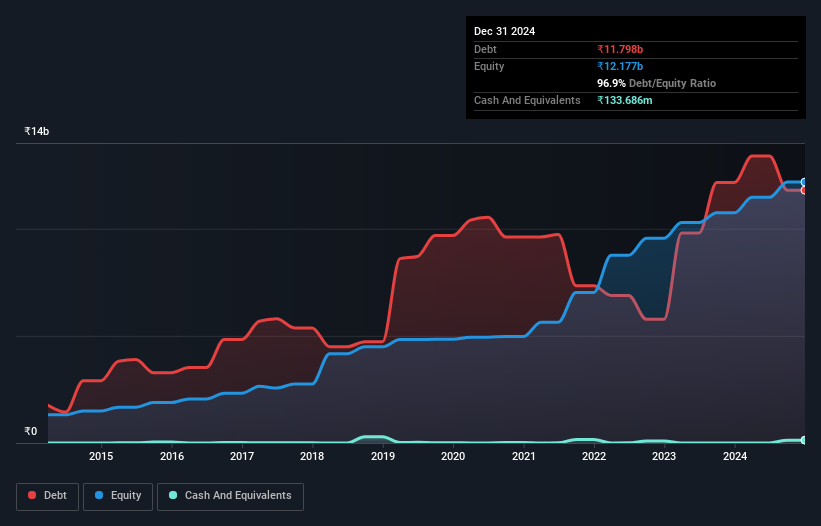

With a net debt to equity ratio of 116.8%, Nitin Spinners operates with significant leverage, though this has reduced from 180.3% over the past five years, indicating some financial improvement. Trading at 44.6% below its estimated fair value suggests potential undervaluation in the market, while earnings growth of 13% last year outpaced the Luxury industry average of 9.9%. The company’s interest payments are well-covered by EBIT at a coverage ratio of three times, reflecting strong operational performance despite not being free cash flow positive recently. Recent inclusion in the S&P Global BMI Index highlights its growing recognition on a global scale.

- Get an in-depth perspective on Nitin Spinners' performance by reading our health report here.

Gain insights into Nitin Spinners' historical performance by reviewing our past performance report.

Supriya Lifescience (NSEI:SUPRIYA)

Simply Wall St Value Rating: ★★★★★★

Overview: Supriya Lifescience Limited is involved in the research, development, manufacture, and sale of bulk drugs and pharmaceutical chemicals globally, with a market cap of ₹44.05 billion.

Operations: Supriya Lifescience Limited generates revenue primarily from the sale of specialty chemicals, amounting to ₹5.99 billion.

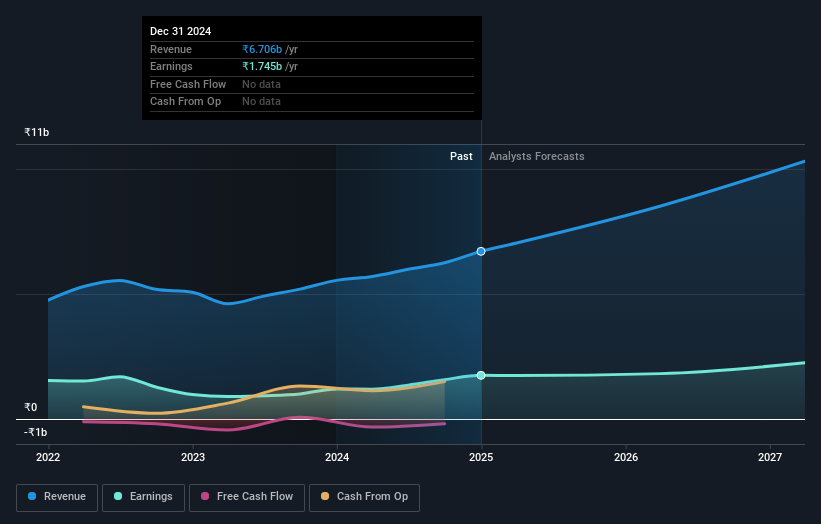

Supriya Lifescience, a dynamic player in India's pharmaceutical landscape, has demonstrated impressive earnings growth of 45.2% over the past year, outpacing the industry’s 19.1%. Its price-to-earnings ratio stands at 32.6x, which is favorable compared to the industry average of 37x. The company boasts strong financial health with an EBIT covering interest payments by a robust 107 times and has successfully reduced its debt-to-equity ratio from 81.8% to just 0.7% over five years. Recent expansions in R&D facilities signal a commitment to innovation and market adaptation for future growth prospects.

Next Steps

- Access the full spectrum of 448 Indian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:J&KBANK

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives