Exploring Undervalued Stocks On The Indian Exchange With Discounts Ranging From 30.8% To 39.7%

Reviewed by Simply Wall St

The Indian stock market has experienced a notable fluctuation recently, declining by 2.0% over the last week but rising by 43% over the past year with earnings expected to grow by 16% annually. In this context, identifying undervalued stocks that offer significant discounts can be particularly compelling for investors looking for potential opportunities in a growing market.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹691.85 | ₹1039.28 | 33.4% |

| HEG (NSEI:HEG) | ₹2133.70 | ₹3288.51 | 35.1% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹415.10 | ₹636.71 | 34.8% |

| Updater Services (NSEI:UDS) | ₹313.90 | ₹537.49 | 41.6% |

| Vedanta (NSEI:VEDL) | ₹432.70 | ₹717.56 | 39.7% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹318.15 | ₹507.63 | 37.3% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹516.70 | ₹878.38 | 41.2% |

| Strides Pharma Science (NSEI:STAR) | ₹1003.00 | ₹1664.05 | 39.7% |

| Delhivery (NSEI:DELHIVERY) | ₹382.70 | ₹750.47 | 49% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3124.65 | ₹5554.45 | 43.7% |

Let's dive into some prime choices out of from the screener.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited is a global pharmaceutical company with operations across North America, Europe, Japan, and India, boasting a market capitalization of approximately ₹220.80 billion.

Operations: The company generates revenue primarily from its pharmaceutical segment, which reported earnings of ₹81.71 billion.

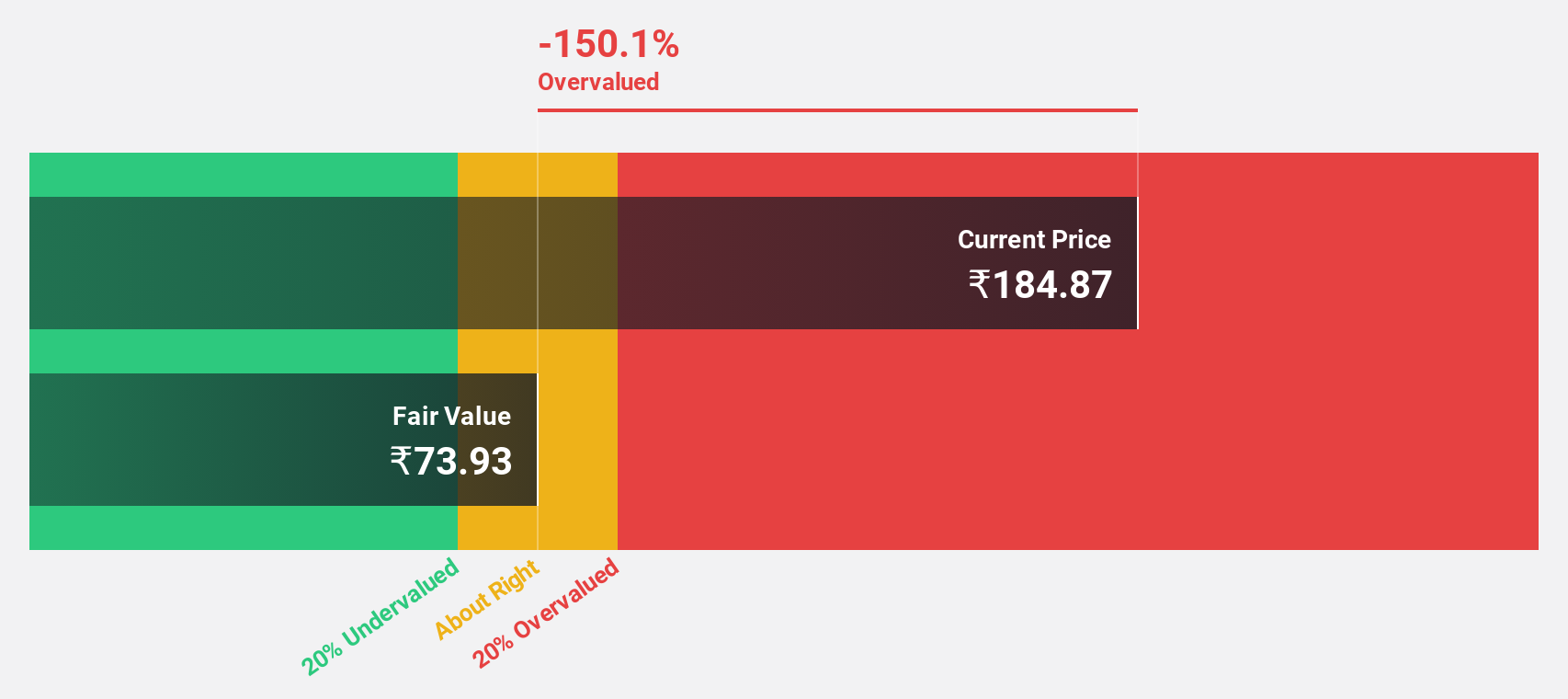

Estimated Discount To Fair Value: 30.8%

Piramal Pharma, trading at ₹166.55, is considered undervalued based on discounted cash flow with a fair value estimate of ₹240.54. Despite recent regulatory challenges, including fines totaling INR 68 million for excise and GST violations from historical operations, the company's financial health appears robust. It reported a significant turnaround with net income reaching INR 178.2 million in FY2024 from a loss the previous year, alongside revenue growth outpacing the Indian market average. Earnings are expected to grow by 67.1% annually, suggesting potential underappreciation by the market.

- Our earnings growth report unveils the potential for significant increases in Piramal Pharma's future results.

- Unlock comprehensive insights into our analysis of Piramal Pharma stock in this financial health report.

Rajesh Exports (NSEI:RAJESHEXPO)

Overview: Rajesh Exports Limited operates in India as a gold refiner and engages in the manufacturing, wholesaling, and retailing of gold and diamond jewelry, along with various other gold products, with a market capitalization of approximately ₹93.94 billion.

Operations: The company generates revenue primarily from gold products, totaling approximately ₹28.09 billion.

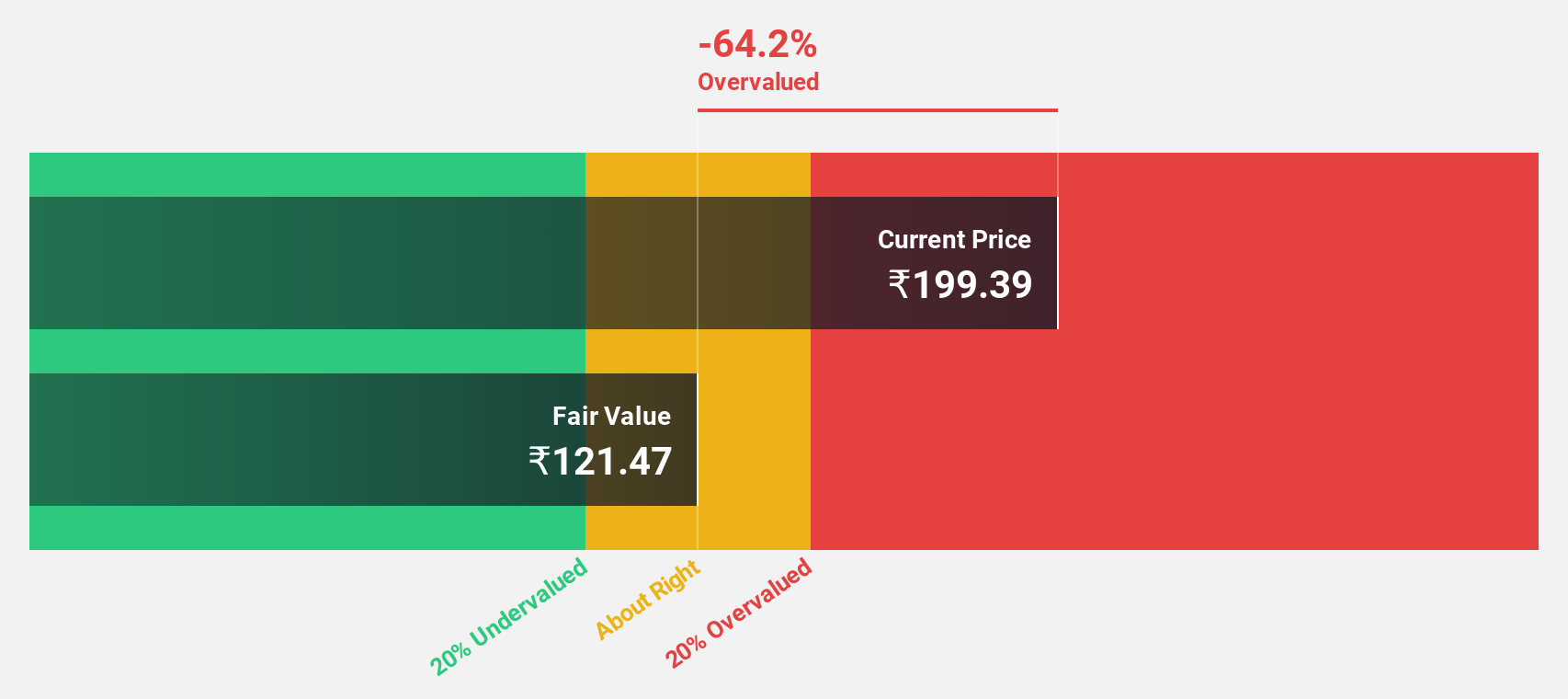

Estimated Discount To Fair Value: 37.3%

Rajesh Exports, priced at ₹318.15, is deemed undervalued with a fair value of ₹507.63, reflecting a 37.3% discount. The company's earnings are expected to grow by 31.7% annually, outpacing the Indian market forecast of 16%. Despite this growth potential and favorable valuation compared to its peers, its profit margins have declined from last year's 0.4% to a current 0.1%, indicating some operational challenges ahead.

- The growth report we've compiled suggests that Rajesh Exports' future prospects could be on the up.

- Dive into the specifics of Rajesh Exports here with our thorough financial health report.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited is a pharmaceutical company that develops, manufactures, and sells products across continents including Africa, Australia, North America, Europe, Asia, and India with a market capitalization of approximately ₹92.19 billion.

Operations: The company generates revenue primarily from its pharmaceutical business, excluding the bio-pharmaceutical segment, amounting to ₹40.51 billion.

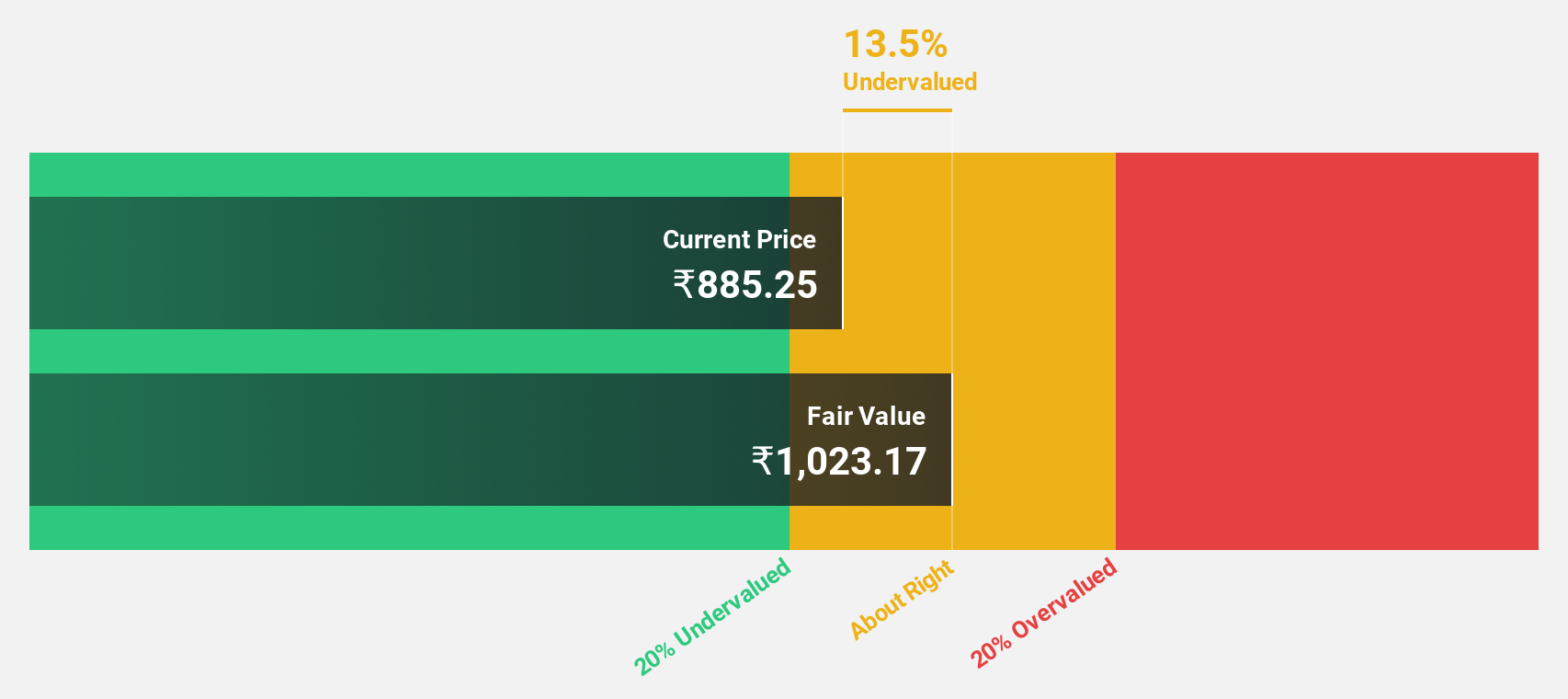

Estimated Discount To Fair Value: 39.7%

Strides Pharma Science, with a current trading price of ₹1003, is significantly undervalued based on DCF analysis, showing a potential discrepancy as it trades 39.7% below the estimated fair value of ₹1664.05. Recent executive shifts aim to enhance leadership in key financial and operational roles, potentially stabilizing future cash flows and governance. Despite low forecasted Return on Equity at 16.2%, revenue growth projections are robust at 11.2% annually, outperforming the Indian market prediction of 9.5%. However, profitability is only expected to turn positive in the next three years, indicating some underlying risks amidst its growth trajectory.

- According our earnings growth report, there's an indication that Strides Pharma Science might be ready to expand.

- Take a closer look at Strides Pharma Science's balance sheet health here in our report.

Turning Ideas Into Actions

- Reveal the 17 hidden gems among our Undervalued Indian Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PPLPHARMA

Piramal Pharma

Operates as a pharmaceutical company in the United States, Europe, Japan, India, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives