Following a rise of over 1 per cent, which ended a three-day losing streak, the Indian stock market benchmark Nifty 50 experienced a nearly 1 per cent drop during intraday trading on Thursday, August 8. The market trend reflects buying on dips and profit booking at higher levels, driven by heightened geopolitical tensions and concerns over US economic growth. In such volatile times, identifying undervalued stocks with strong fundamentals can offer significant opportunities for long-term investors.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2048.35 | ₹3925.18 | 47.8% |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹720.20 | ₹1129.82 | 36.3% |

| S Chand (NSEI:SCHAND) | ₹224.63 | ₹356.66 | 37% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1352.15 | ₹2171.22 | 37.7% |

| RITES (NSEI:RITES) | ₹690.05 | ₹1047.33 | 34.1% |

| Updater Services (NSEI:UDS) | ₹319.40 | ₹632.21 | 49.5% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹908.25 | ₹1509.79 | 39.8% |

| Texmaco Rail & Engineering (NSEI:TEXRAIL) | ₹243.25 | ₹397.35 | 38.8% |

| Piramal Pharma (NSEI:PPLPHARMA) | ₹185.05 | ₹289.56 | 36.1% |

| Strides Pharma Science (NSEI:STAR) | ₹1139.60 | ₹2032.10 | 43.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Prataap Snacks (NSEI:DIAMONDYD)

Overview: Prataap Snacks Limited operates a snacks food business in India and internationally with a market cap of ₹21.68 billion.

Operations: The company's revenue segment is primarily derived from its snacks food business, generating ₹16.52 billion.

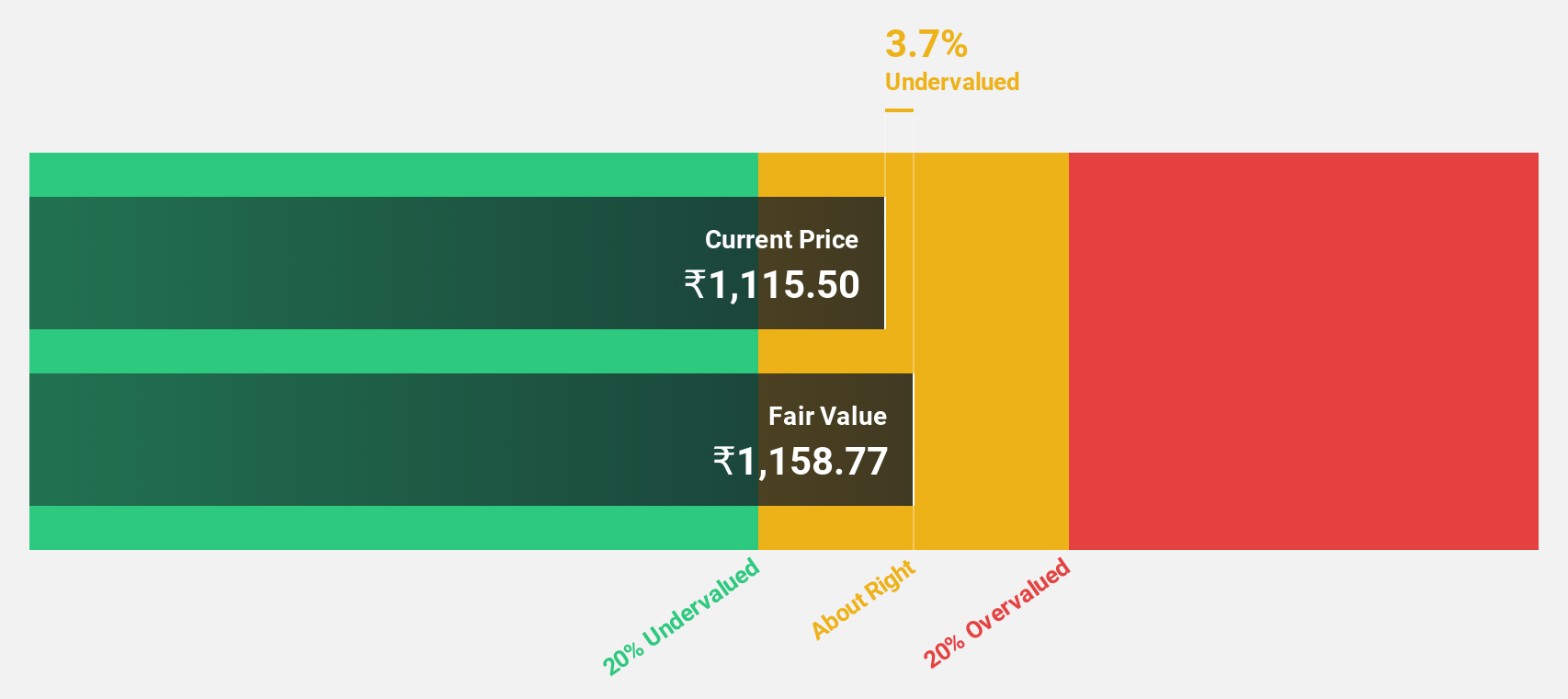

Estimated Discount To Fair Value: 39.8%

Prataap Snacks is trading at a significant discount to its estimated fair value, making it an intriguing candidate for undervalued stocks based on cash flows. Despite recent insider selling and a decline in quarterly net income to ₹94.39 million from ₹134.25 million last year, the company's earnings are forecasted to grow significantly over the next three years. Additionally, Prataap Snacks' revenue has shown consistent growth, reaching ₹4.24 billion in the latest quarter compared to ₹3.89 billion previously.

- Our earnings growth report unveils the potential for significant increases in Prataap Snacks' future results.

- Unlock comprehensive insights into our analysis of Prataap Snacks stock in this financial health report.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited operates as a pharmaceutical company serving North America, Europe, Japan, India, and other international markets with a market cap of ₹245.33 billion.

Operations: The company generates revenue primarily from its pharmaceutical segment, which amounts to ₹83.73 billion.

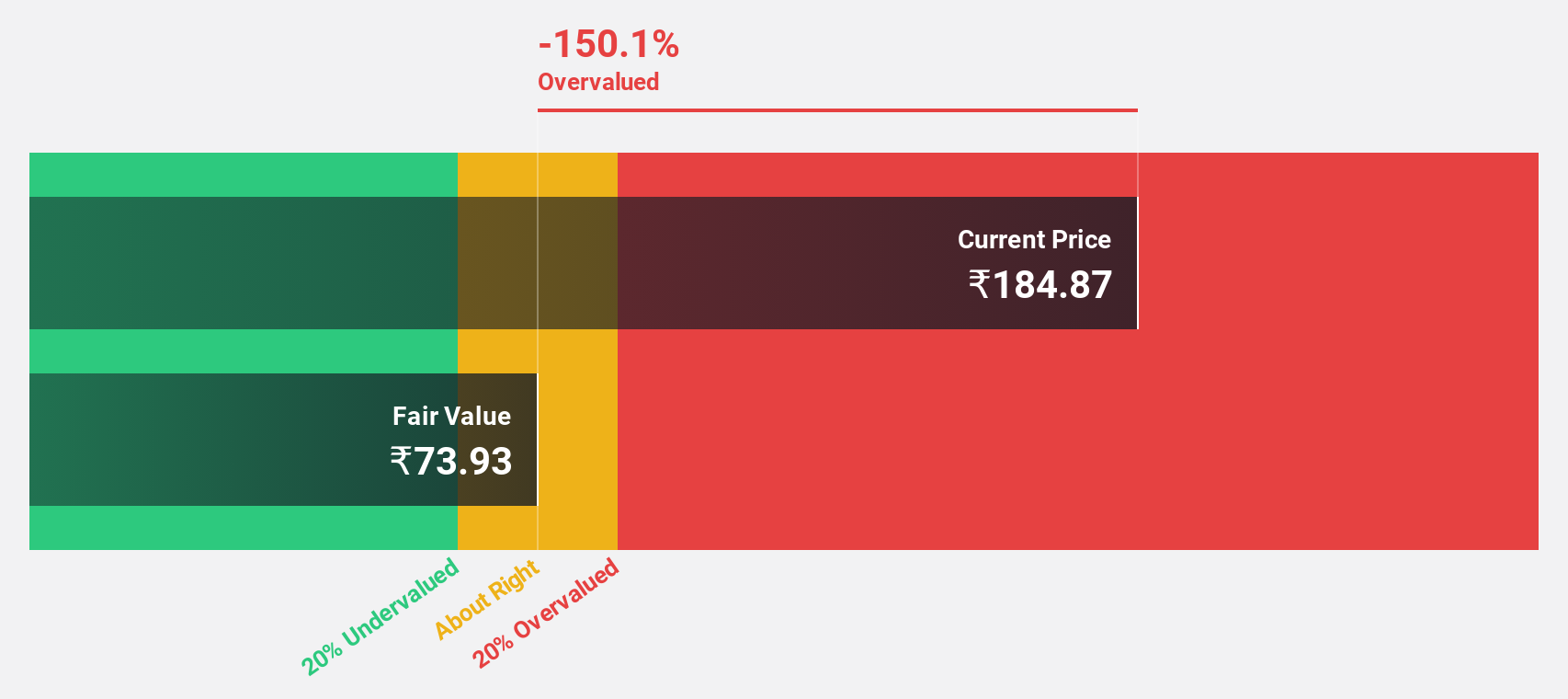

Estimated Discount To Fair Value: 36.1%

Piramal Pharma is trading at a significant discount to its estimated fair value of ₹289.56, currently priced at ₹185.05. Despite reporting a net loss of ₹886.4 million for Q1 2025, the company's earnings are forecasted to grow significantly at 73% per year over the next three years, outpacing the Indian market's average growth rate. However, interest payments are not well covered by earnings and shareholders have faced dilution in the past year.

- Our growth report here indicates Piramal Pharma may be poised for an improving outlook.

- Navigate through the intricacies of Piramal Pharma with our comprehensive financial health report here.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products globally with a market cap of ₹104.80 billion.

Operations: The company's primary revenue segment is its Pharmaceutical Business (excluding Bio-Pharmaceutical Business), which generated ₹42.09 billion.

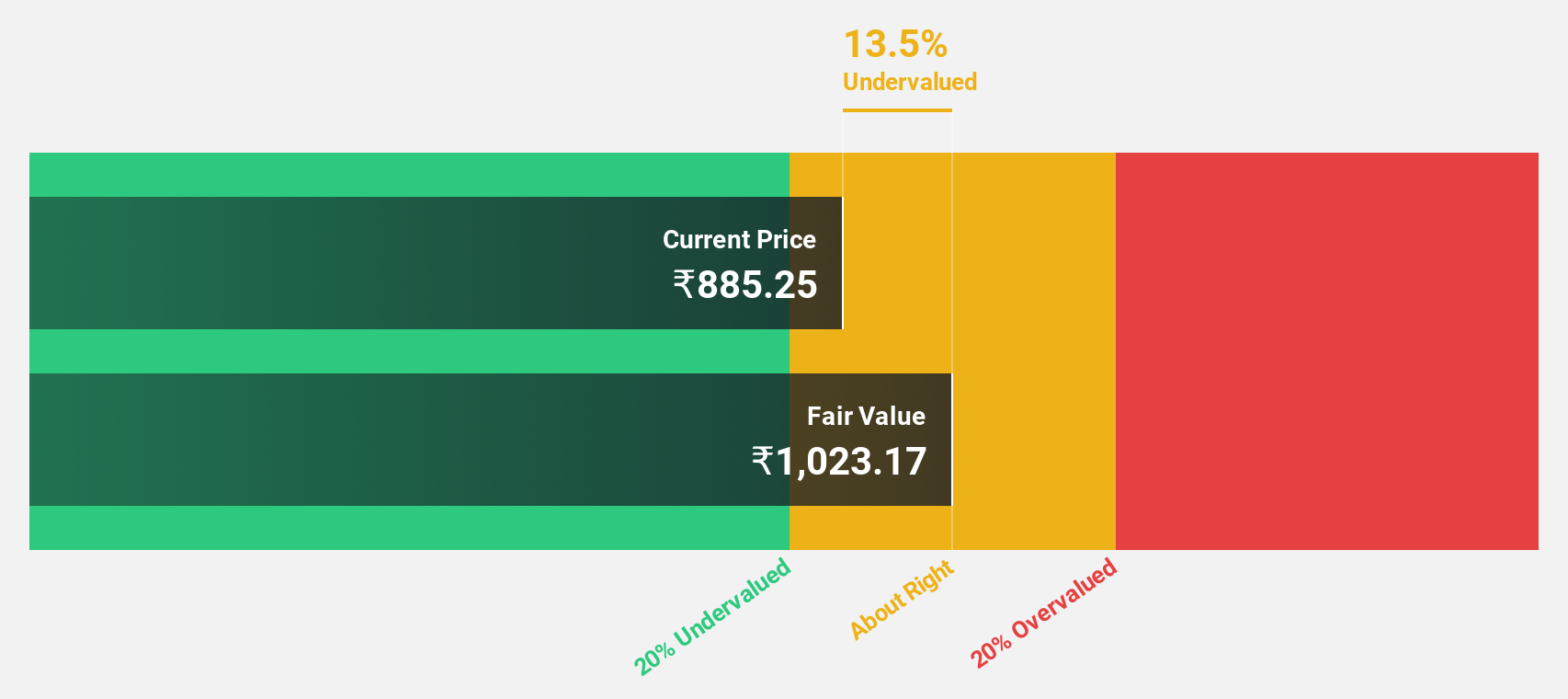

Estimated Discount To Fair Value: 43.9%

Strides Pharma Science is trading at ₹1139.6, significantly below its estimated fair value of ₹2032.1, indicating a potential undervaluation based on cash flows. The company reported strong Q1 2024 results with net income of ₹702.02 million compared to a net loss last year, and revenue growth from ₹9,386.39 million to ₹11,002.21 million. Despite recent board changes and leadership transitions, the company's earnings are forecasted to grow by 98% annually over the next three years.

- Insights from our recent growth report point to a promising forecast for Strides Pharma Science's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Strides Pharma Science.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 25 Undervalued Indian Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PPLPHARMA

Piramal Pharma

Operates as a pharmaceutical company in North America, Europe, Japan, India, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives