3 Indian Exchange Stocks Estimated To Be Up To 40.6% Undervalued

Reviewed by Simply Wall St

In the last week, the Indian market has stayed flat, while the Communication Services sector gained 4.7%, contributing to an impressive 45% rise over the past year. With earnings forecasted to grow by 17% annually, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹187.06 | ₹306.08 | 38.9% |

| Apollo Pipes (BSE:531761) | ₹604.85 | ₹1147.92 | 47.3% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹713.40 | ₹1165.33 | 38.8% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2385.05 | ₹4380.61 | 45.6% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹442.00 | ₹762.32 | 42% |

| Updater Services (NSEI:UDS) | ₹343.50 | ₹621.14 | 44.7% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹857.75 | ₹1509.79 | 43.2% |

| Patel Engineering (BSE:531120) | ₹53.64 | ₹91.76 | 41.5% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹264.30 | ₹445.15 | 40.6% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹295.15 | ₹586.23 | 49.7% |

Let's explore several standout options from the results in the screener.

Artemis Medicare Services (NSEI:ARTEMISMED)

Overview: Artemis Medicare Services Limited manages and operates multi-specialty hospitals in India and internationally, with a market cap of ₹36.37 billion.

Operations: Artemis Medicare Services Limited generates revenue primarily from healthcare services, amounting to ₹8.92 billion.

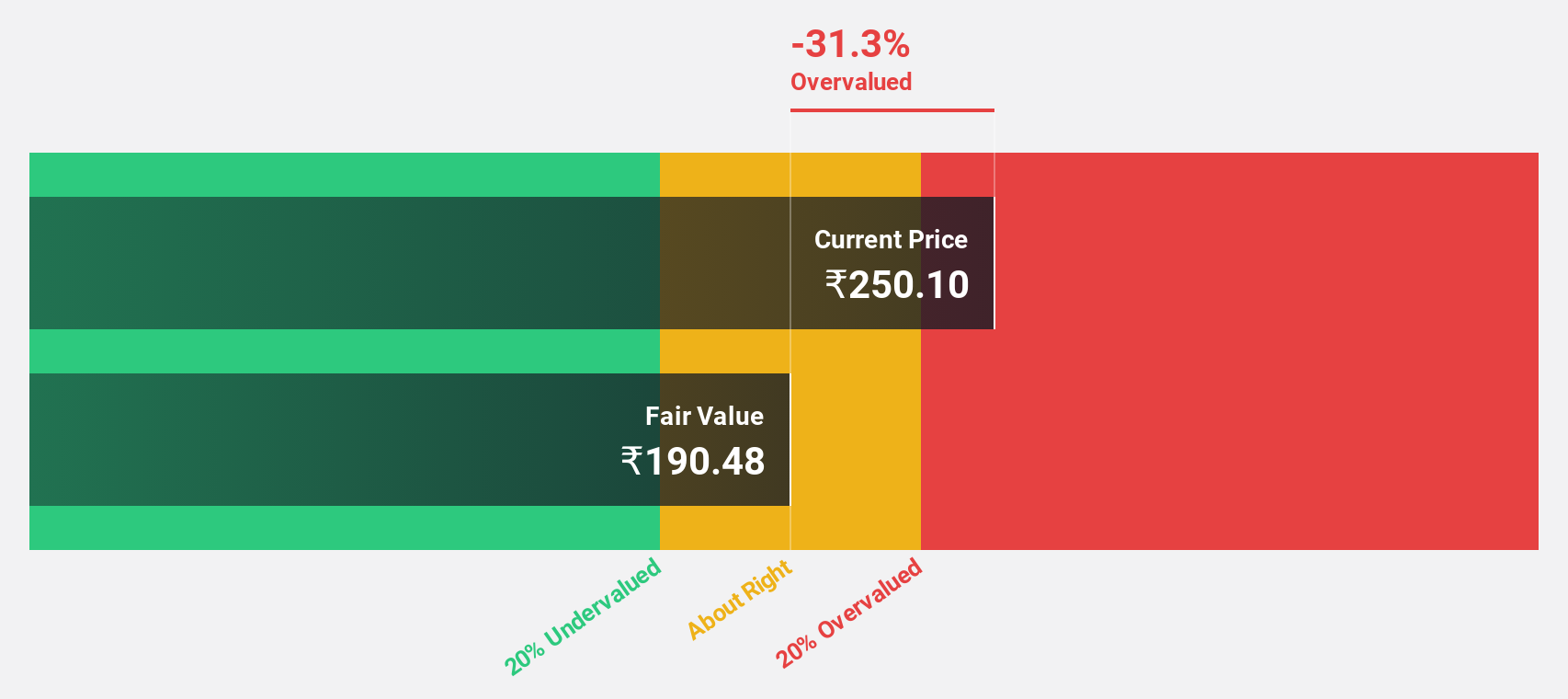

Estimated Discount To Fair Value: 40.6%

Artemis Medicare Services appears undervalued based on cash flows, trading at ₹264.3, significantly below its estimated fair value of ₹445.15. Despite high debt levels, the company has shown robust earnings growth of 40% over the past year and is forecast to grow earnings by 45.4% annually, outpacing the Indian market's average growth rate. Recent quarterly results also reflect strong performance with increased revenue and net income compared to last year.

- According our earnings growth report, there's an indication that Artemis Medicare Services might be ready to expand.

- Navigate through the intricacies of Artemis Medicare Services with our comprehensive financial health report here.

Fusion Finance (NSEI:FUSION)

Overview: Fusion Finance Limited, a non-banking financial company with a market cap of ₹31.24 billion, provides microfinance lending services to women entrepreneurs in rural and semi-urban areas in India.

Operations: The company's revenue from micro financing activities amounts to ₹10.98 billion.

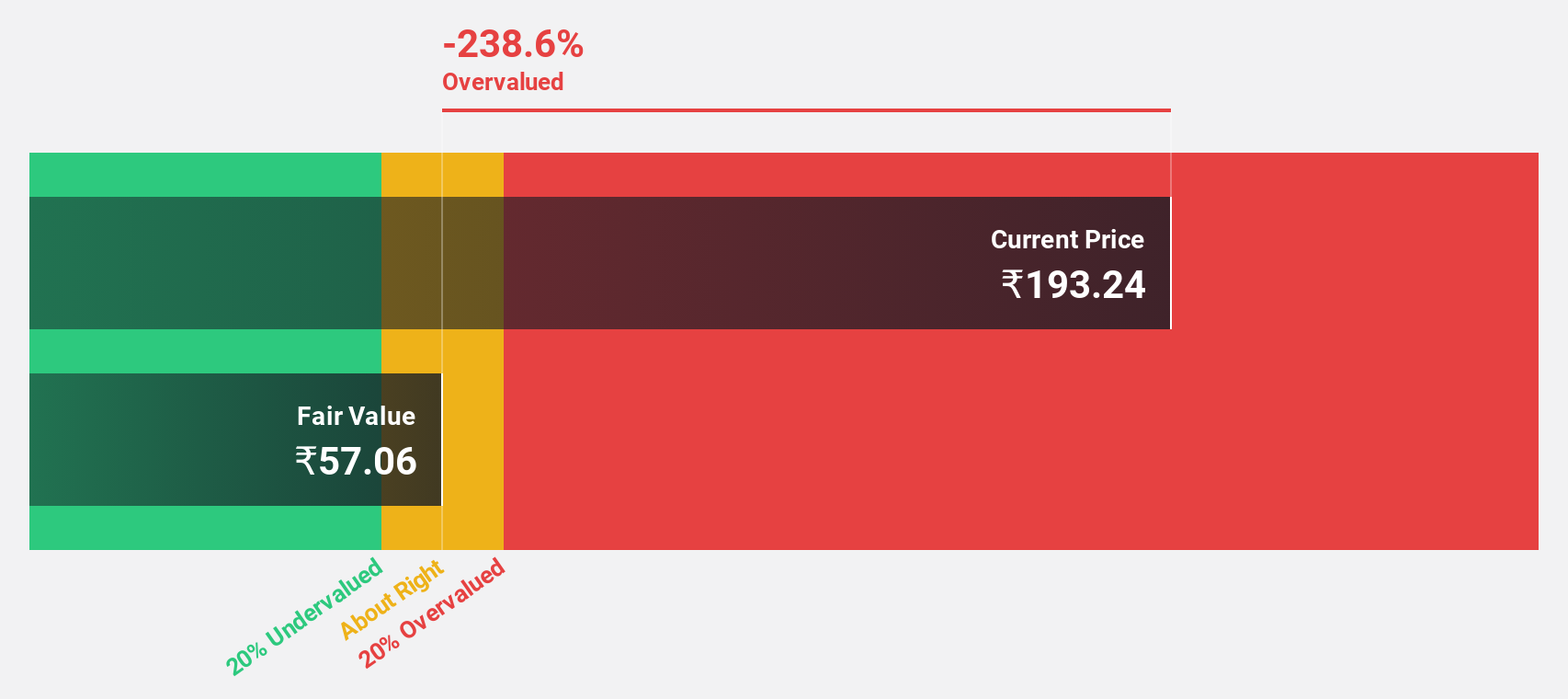

Estimated Discount To Fair Value: 18.5%

Fusion Finance is trading at ₹310.4, below its estimated fair value of ₹380.67, indicating it may be undervalued based on cash flows. The company's revenue is forecast to grow 29.4% per year, significantly outpacing the Indian market's 10% growth rate. However, earnings are expected to grow by 24.7%, and recent financial results show a net loss of ₹356.2 million for Q1 2024 compared to a net income of ₹1,204.6 million last year.

- Insights from our recent growth report point to a promising forecast for Fusion Finance's business outlook.

- Click here to discover the nuances of Fusion Finance with our detailed financial health report.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across various regions globally and has a market cap of ₹120.77 billion.

Operations: The company generates ₹42.09 billion in revenue from its pharmaceutical business excluding bio-pharmaceuticals.

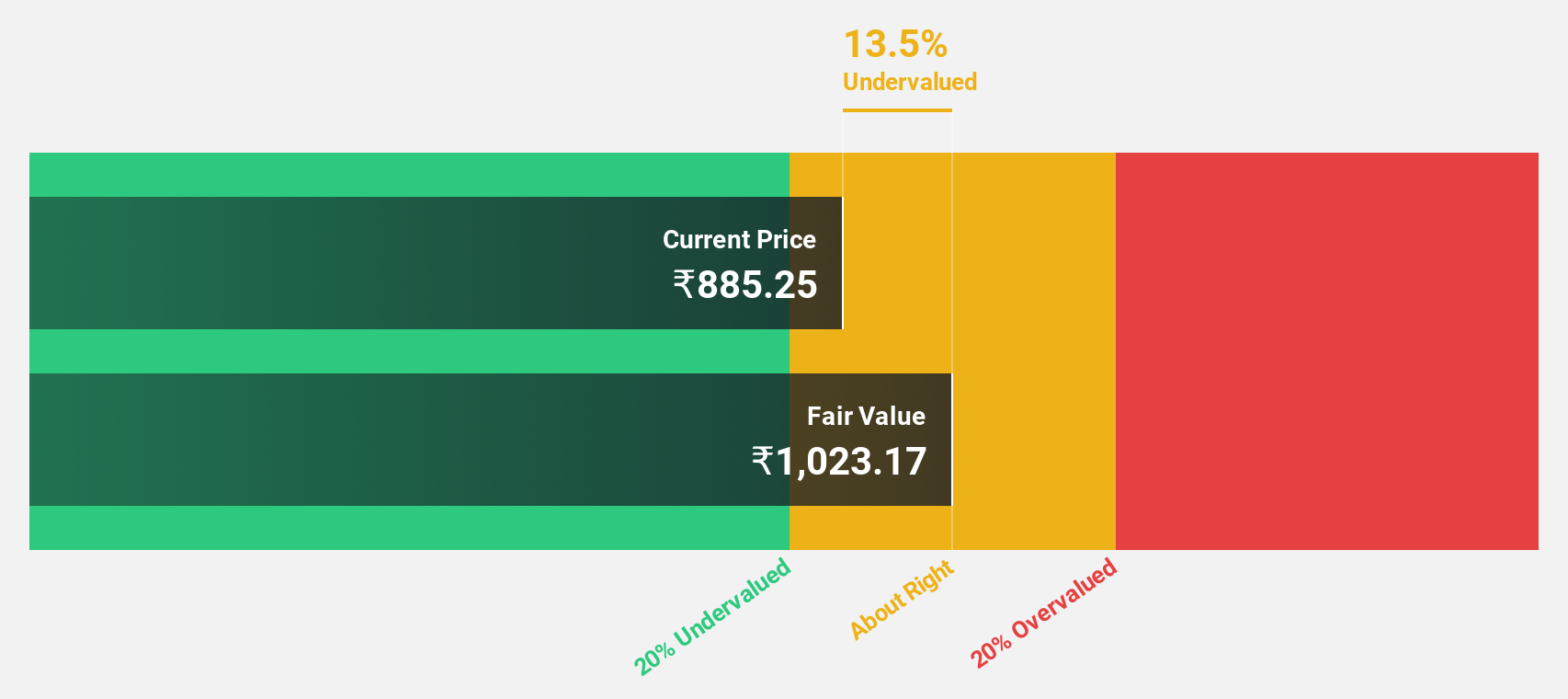

Estimated Discount To Fair Value: 35.4%

Strides Pharma Science is trading at ₹1,313.35, significantly below its estimated fair value of ₹2,032.10, suggesting it is undervalued based on cash flows. The company reported a net income of ₹702.02 million for Q1 2024 compared to a net loss last year and announced a final dividend of ₹2.50 per share for FY 2024. Despite recent board changes and the departure of key directors, Strides' revenue growth forecast remains robust at 11.6% annually.

- Our comprehensive growth report raises the possibility that Strides Pharma Science is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Strides Pharma Science's balance sheet health report.

Summing It All Up

- Gain an insight into the universe of 31 Undervalued Indian Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:STAR

Strides Pharma Science

Develops, manufactures, and sells pharmaceutical products in Africa, Australia, North America, Europe, Asia, India, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives