Slammed 32% Solara Active Pharma Sciences Limited (NSE:SOLARA) Screens Well Here But There Might Be A Catch

Solara Active Pharma Sciences Limited (NSE:SOLARA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. The last month has meant the stock is now only up 6.6% during the last year.

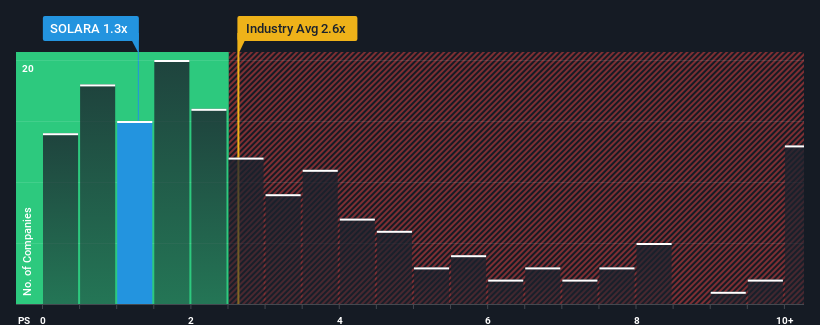

Following the heavy fall in price, Solara Active Pharma Sciences may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Pharmaceuticals industry in India have P/S ratios greater than 2.6x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Solara Active Pharma Sciences

How Solara Active Pharma Sciences Has Been Performing

Solara Active Pharma Sciences hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Solara Active Pharma Sciences' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Solara Active Pharma Sciences?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Solara Active Pharma Sciences' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.2% decrease to the company's top line. As a result, revenue from three years ago have also fallen 4.3% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the sole analyst following the company. That's shaping up to be similar to the 11% growth forecast for the broader industry.

With this information, we find it odd that Solara Active Pharma Sciences is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Solara Active Pharma Sciences' P/S Mean For Investors?

Solara Active Pharma Sciences' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Solara Active Pharma Sciences remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Solara Active Pharma Sciences (at least 2 which are a bit unpleasant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOLARA

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, exports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India, Asia Pacific, Europe, North America, South America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives