- India

- /

- Professional Services

- /

- NSEI:RITES

3 Indian Exchange Stocks Estimated To Be 24.9% To 35.3% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.0%, but it remains up 39% over the past year with earnings forecast to grow by 17% annually. In this context, identifying undervalued stocks that are trading significantly below their intrinsic value can present compelling opportunities for investors seeking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹186.99 | ₹306.10 | 38.9% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹813.65 | ₹1509.79 | 46.1% |

| Apollo Pipes (BSE:531761) | ₹631.15 | ₹1153.60 | 45.3% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2250.95 | ₹4449.35 | 49.4% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1374.00 | ₹2188.06 | 37.2% |

| Patel Engineering (BSE:531120) | ₹59.11 | ₹94.56 | 37.5% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹479.70 | ₹762.32 | 37.1% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹277.65 | ₹445.15 | 37.6% |

| Tarsons Products (NSEI:TARSONS) | ₹449.60 | ₹710.14 | 36.7% |

| Strides Pharma Science (NSEI:STAR) | ₹1309.15 | ₹2032.10 | 35.6% |

Here we highlight a subset of our preferred stocks from the screener.

Orchid Pharma (NSEI:ORCHPHARMA)

Overview: Orchid Pharma Limited is an Indian pharmaceutical company involved in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals with a market cap of ₹75.10 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, amounting to ₹8.81 billion.

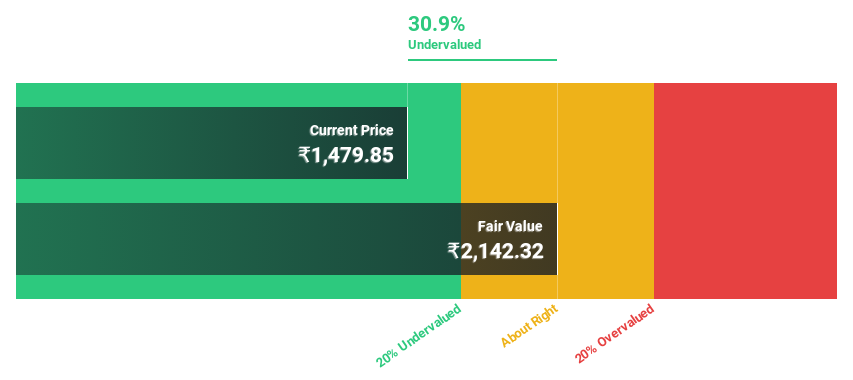

Estimated Discount To Fair Value: 30.9%

Orchid Pharma, trading at ₹1480.7, is significantly undervalued based on cash flows with an estimated fair value of ₹2142.32. Despite a recent GST enforcement action resulting in a liability of approximately ₹49.95 million, the company reported robust Q1 2024 earnings with net income rising to ₹293.51 million from ₹94.05 million year-over-year. Revenue and earnings are forecasted to grow at impressive rates of 31.8% and 43.7% annually, respectively, outpacing the broader Indian market growth rates.

- The growth report we've compiled suggests that Orchid Pharma's future prospects could be on the up.

- Take a closer look at Orchid Pharma's balance sheet health here in our report.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited is a pharmaceutical company with operations in North America, Europe, Japan, India, and internationally, and has a market cap of ₹300.03 billion.

Operations: Piramal Pharma Limited generates revenue primarily from its pharma segment, amounting to ₹83.73 billion.

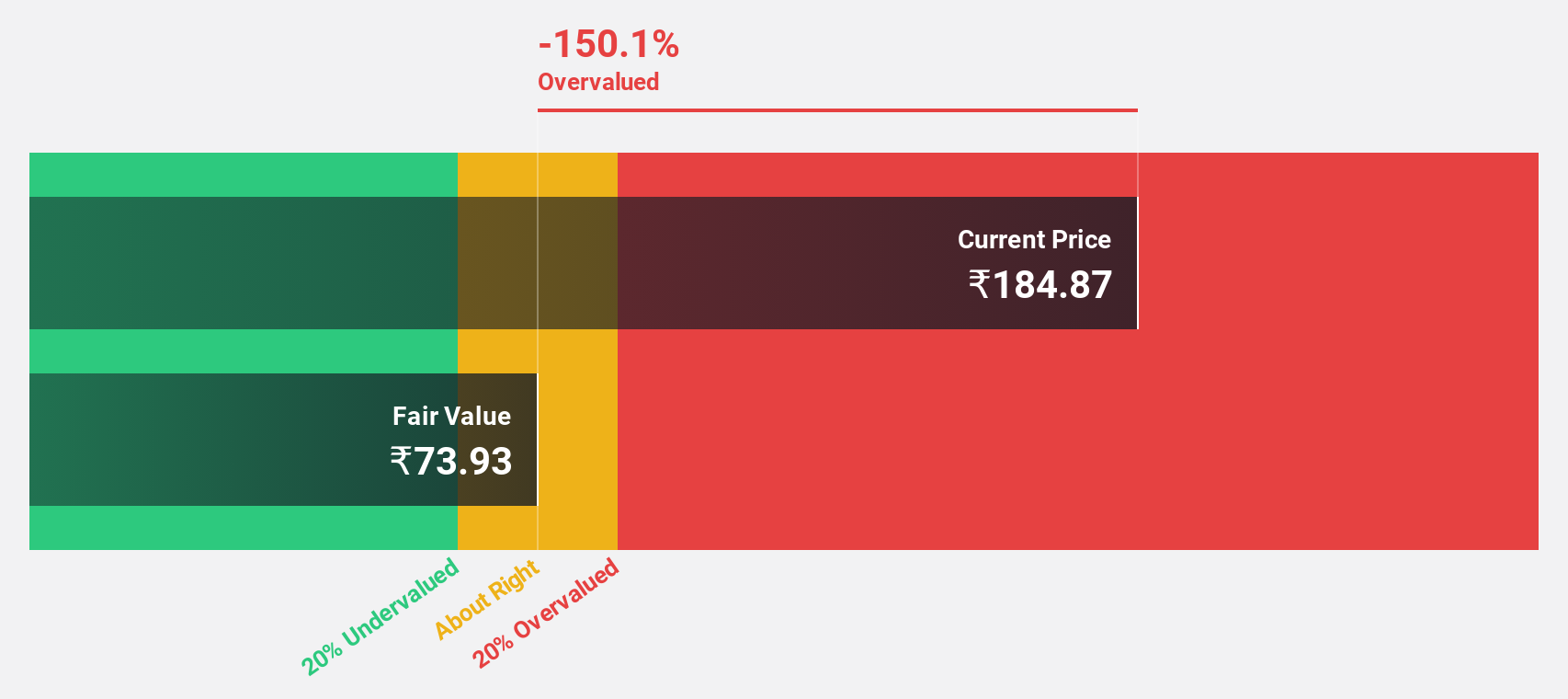

Estimated Discount To Fair Value: 24.9%

Piramal Pharma, trading at ₹217.34, is undervalued with an estimated fair value of ₹289.56. Despite a net loss of ₹886.4 million for Q1 2024, the company’s earnings are projected to grow significantly at 73.5% per year, outpacing the Indian market's growth rate of 17%. However, interest payments are not well covered by earnings and regulatory penalties might impact short-term financials but aren't expected to materially affect operations long-term.

- Our growth report here indicates Piramal Pharma may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Piramal Pharma.

RITES (NSEI:RITES)

Overview: RITES Limited, with a market cap of ₹161.66 billion, offers design, engineering consultancy, and project management services across railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways and renewable energy sectors.

Operations: The company's revenue segments include Export Sale (₹699 million), Power Generation (₹177.80 million), Leasing - Domestic (₹1.41 billion), Consultancy - Abroad (₹766.10 million), Consultancy - Domestic (₹11.79 billion), and Turnkey Construction Projects - Domestic (₹9.10 billion).

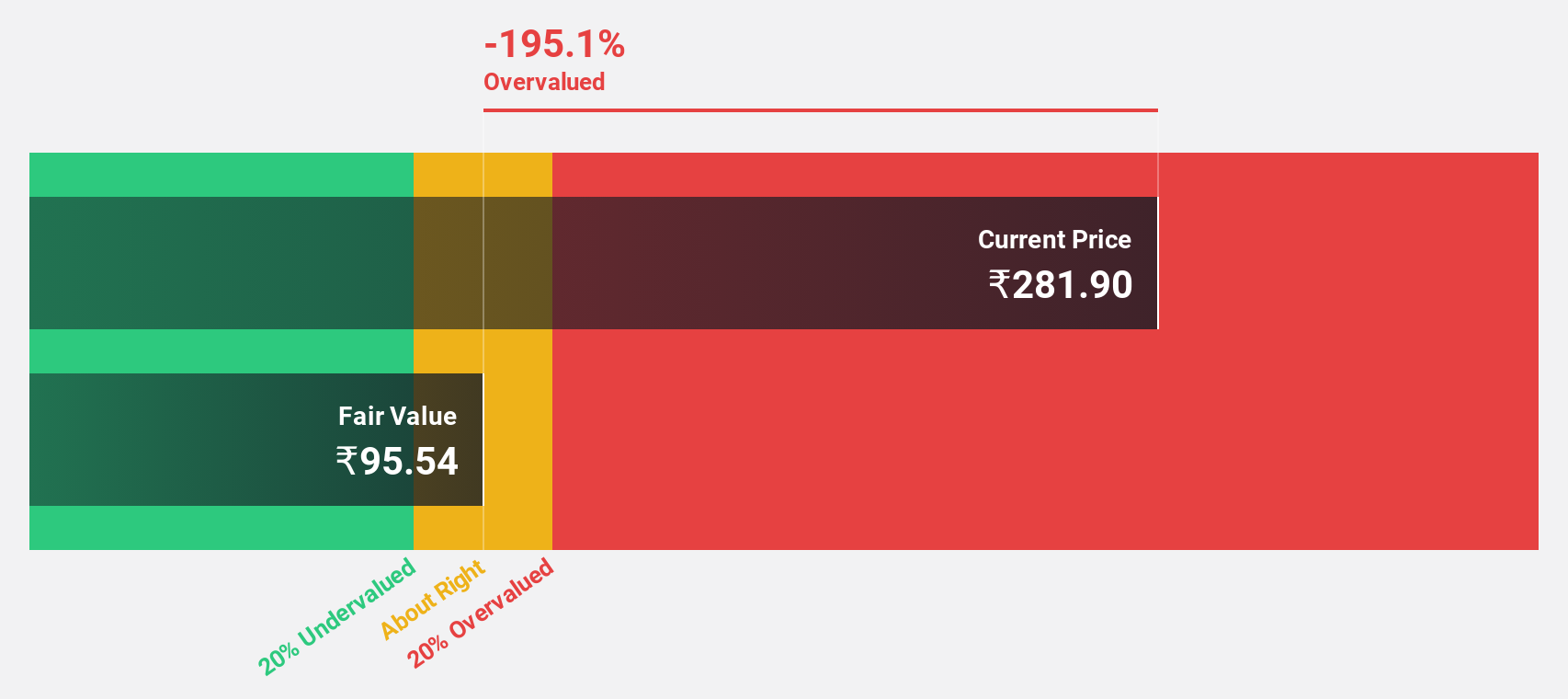

Estimated Discount To Fair Value: 35.3%

RITES Limited, trading at ₹672.75, appears undervalued with an estimated fair value of ₹1039.31. The company’s recent wins include a ₹600.3 million consultancy bid in Uttar Pradesh and a $26.74 million international tender in Tanzania, bolstering its revenue prospects. However, regulatory tax demands totaling ₹1.94 billion may impact short-term finances but are not expected to affect operations significantly long-term as the company plans to appeal these orders.

- Our comprehensive growth report raises the possibility that RITES is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of RITES.

Summing It All Up

- Embark on your investment journey to our 29 Undervalued Indian Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RITES

RITES

Provides design, engineering consultancy, and project management services in the field of railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways, and renewable energy.

Flawless balance sheet and undervalued.