Morepen Laboratories' (NSE:MOREPENLAB) 40% CAGR outpaced the company's earnings growth over the same five-year period

The last three months have been tough on Morepen Laboratories Limited (NSE:MOREPENLAB) shareholders, who have seen the share price decline a rather worrying 37%. But that doesn't undermine the fantastic longer term performance (measured over five years). Indeed, the share price is up a whopping 434% in that time. So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Since it's been a strong week for Morepen Laboratories shareholders, let's have a look at trend of the longer term fundamentals.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

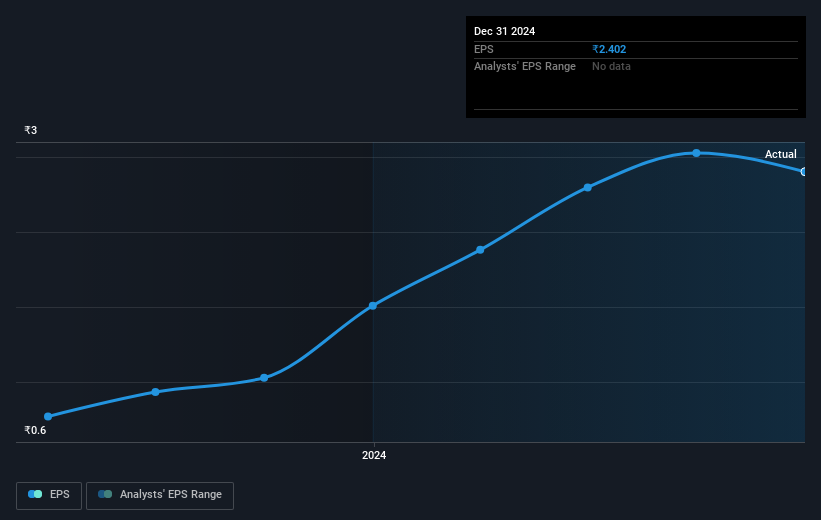

Over half a decade, Morepen Laboratories managed to grow its earnings per share at 26% a year. This EPS growth is slower than the share price growth of 40% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Morepen Laboratories' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Morepen Laboratories shareholders have received a total shareholder return of 17% over one year. However, that falls short of the 40% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before deciding if you like the current share price, check how Morepen Laboratories scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MOREPENLAB

Morepen Laboratories

Develops, manufactures, markets, and sells active pharmaceutical ingredients (APIs), formulations, and home health products in India, the United States, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives