- India

- /

- Auto Components

- /

- NSEI:SHRIPISTON

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, but it has impressively risen by 41% over the past 12 months. In light of this growth and with earnings expected to increase by 17% per annum in the coming years, identifying promising stocks that are currently underappreciated can be a strategic move for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 31.02% | 50.24% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

D. P. Abhushan (NSEI:DPABHUSHAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: D. P. Abhushan Limited engages in the manufacturing, sale, and trading of gold, diamond, platinum, silver, and other precious metals and ornaments in India with a market cap of ₹36.81 billion.

Operations: D. P. Abhushan generates revenue primarily from its Gems & Jewellery segment, amounting to ₹23.74 billion. The company's market cap stands at ₹36.81 billion.

D. P. Abhushan, a smaller player in the Indian jewelry retail sector, reported Q1 2024 sales of ₹5.05 billion and net income of ₹250.77 million, showing significant growth from last year’s figures. The company’s earnings grew by 48.5% over the past year, outpacing its industry’s 23% growth rate, and EBIT covers interest payments 9.3 times over. Debt to equity ratio has improved from 187% to 73%, though net debt to equity remains high at 61%.

- Get an in-depth perspective on D. P. Abhushan's performance by reading our health report here.

Explore historical data to track D. P. Abhushan's performance over time in our Past section.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, is involved in the research, manufacturing, marketing, and sale of pharmaceutical formulations across the United States, North America, Europe, the United Kingdom, Australia, New Zealand and other international markets with a market cap of ₹119.45 billion.

Operations: Marksans Pharma derives its revenue primarily from the sale of pharmaceutical formulations, amounting to ₹22.68 billion. The company's market cap stands at ₹119.45 billion.

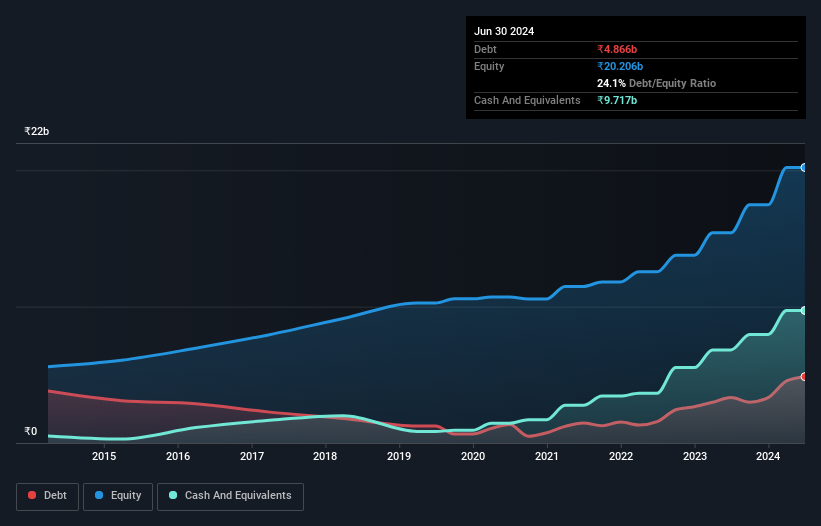

Marksans Pharma, a small-cap pharmaceutical company, has shown impressive growth with earnings increasing 21.7% over the past year, outperforming the industry average of 19.2%. The company’s debt-to-equity ratio decreased from 19.9% to 11.7% in five years, indicating strong financial health. Recent news highlights include a successful USFDA inspection and plans for M&A to expand into European markets. For Q1 FY25, Marksans reported net income of INR 887 million and basic EPS of INR 1.96 compared to INR 1.52 last year.

- Unlock comprehensive insights into our analysis of Marksans Pharma stock in this health report.

Examine Marksans Pharma's past performance report to understand how it has performed in the past.

Shriram Pistons & Rings (NSEI:SHRIPISTON)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shriram Pistons & Rings Limited manufactures and sells automotive components in India, with a market cap of ₹103.42 billion.

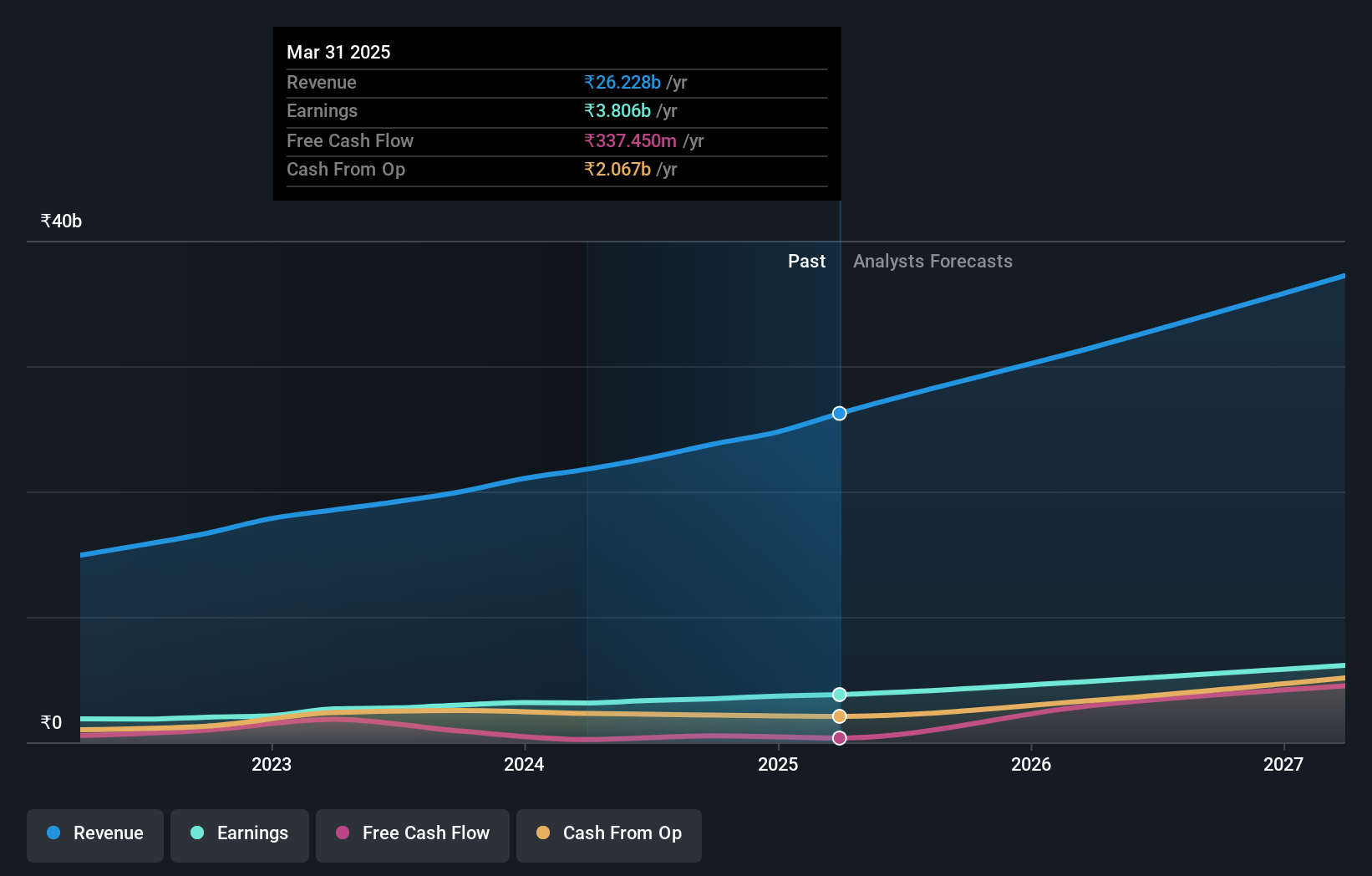

Operations: The company generates revenue primarily from the sale of automotive components, amounting to ₹32.10 billion. With a market cap of ₹103.42 billion, Shriram Pistons & Rings Limited focuses its financial performance on this single revenue stream.

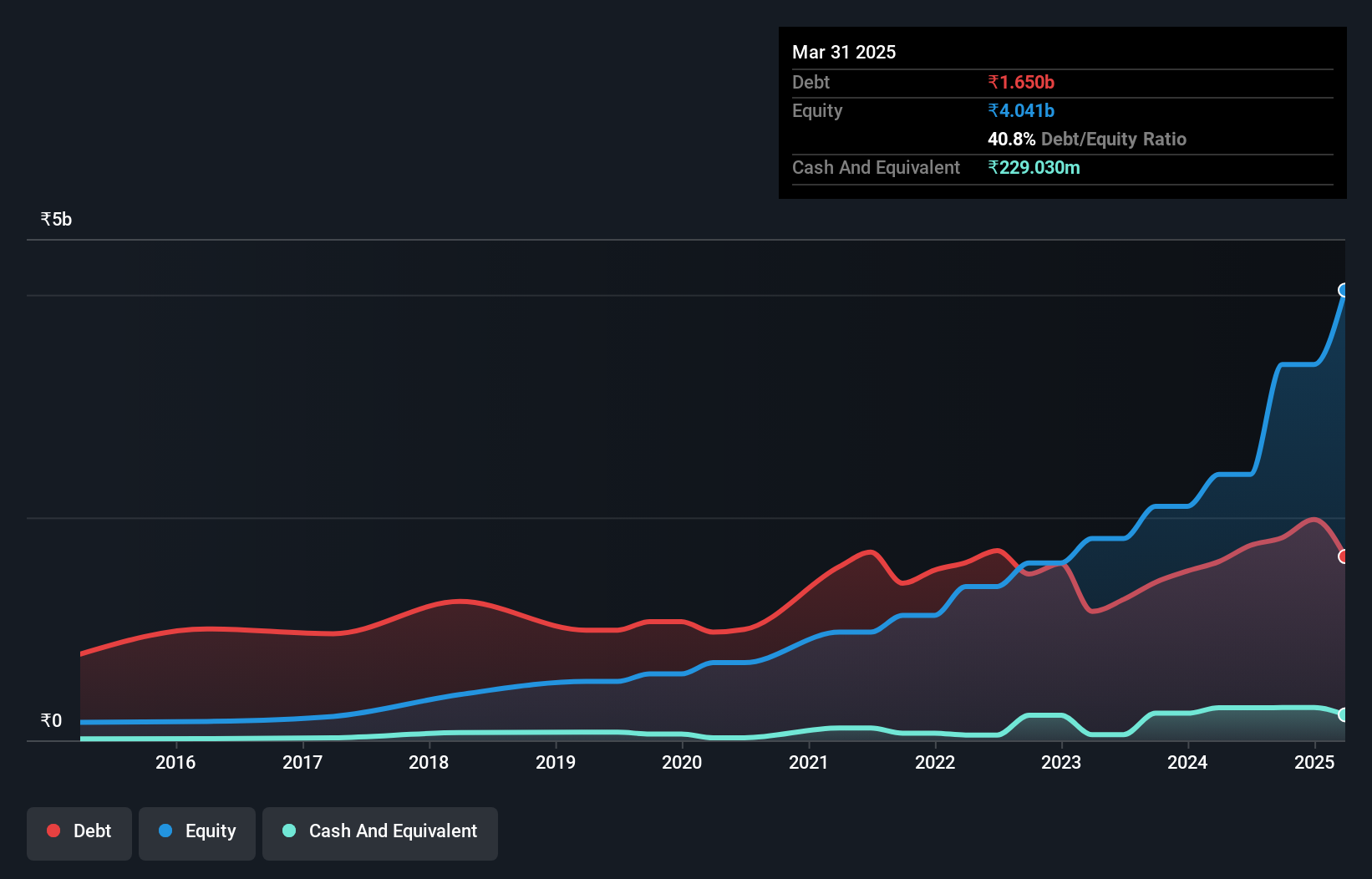

Shriram Pistons & Rings, known for its robust performance in the auto components sector, reported notable earnings growth of 33.7% over the past year, outpacing industry growth of 20.1%. The company’s debt to equity ratio has risen from 12.2% to 24.1% in five years, yet interest payments are well covered by EBIT at a ratio of 16.6x. Trading at a price-to-earnings ratio of 22.7x against the Indian market's average of 34.3x suggests good relative value for investors.

- Click here to discover the nuances of Shriram Pistons & Rings with our detailed analytical health report.

Learn about Shriram Pistons & Rings' historical performance.

Next Steps

- Click here to access our complete index of 476 Indian Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SHRIPISTON

Shriram Pistons & Rings

Manufactures and sells automotive components in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives