Does Lincoln Pharmaceuticals (NSE:LINCOLN) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Lincoln Pharmaceuticals (NSE:LINCOLN). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Lincoln Pharmaceuticals

How Quickly Is Lincoln Pharmaceuticals Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that Lincoln Pharmaceuticals has managed to grow EPS by 34% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

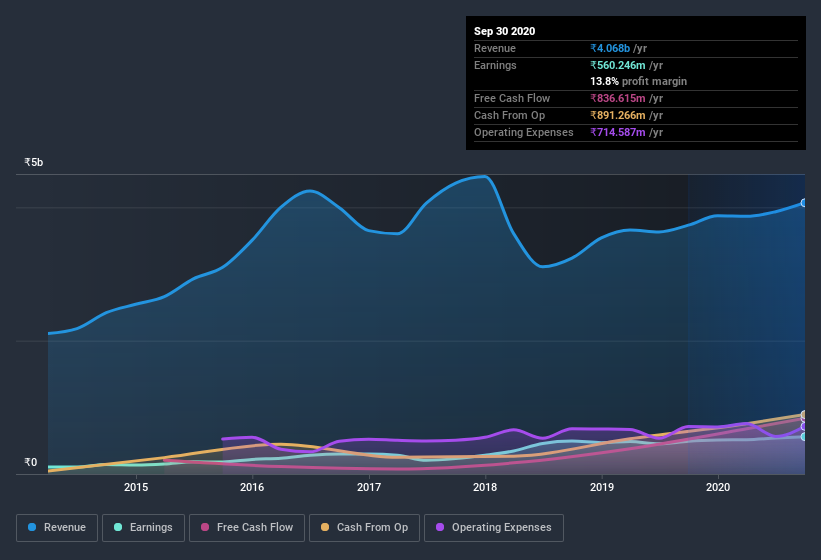

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Lincoln Pharmaceuticals's EBIT margins were flat over the last year, revenue grew by a solid 9.0% to ₹4.1b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Lincoln Pharmaceuticals is no giant, with a market capitalization of ₹4.5b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Lincoln Pharmaceuticals Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Lincoln Pharmaceuticals shareholders can gain quiet confidence from the fact that insiders shelled out ₹56m to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. It is also worth noting that it was Whole Time Director Munjal Patel who made the biggest single purchase, worth ₹20m, paying ₹245 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Lincoln Pharmaceuticals insiders own more than a third of the company. Actually, with 43% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have ₹1.9b invested in the business, using the current share price. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Mahendrabhai Patel is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations under ₹15b, like Lincoln Pharmaceuticals, the median CEO pay is around ₹3.3m.

The CEO of Lincoln Pharmaceuticals was paid just ₹2.3m in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Lincoln Pharmaceuticals Deserve A Spot On Your Watchlist?

For growth investors like me, Lincoln Pharmaceuticals's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Lincoln Pharmaceuticals you should be aware of.

As a growth investor I do like to see insider buying. But Lincoln Pharmaceuticals isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Lincoln Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Lincoln Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LINCOLN

Lincoln Pharmaceuticals

Engages in manufacturing and trading of pharmaceutical products in India.

Flawless balance sheet established dividend payer.