Shareholders Are Raving About How The Laurus Labs (NSE:LAURUSLABS) Share Price Increased 331%

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When you find (and hold) a big winner, you can markedly improve your finances. For example, Laurus Labs Limited (NSE:LAURUSLABS) has generated a beautiful 331% return in just a single year. On top of that, the share price is up 37% in about a quarter. But this could be related to the strong market, which is up 21% in the last three months. Looking back further, the stock price is 257% higher than it was three years ago.

View our latest analysis for Laurus Labs

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

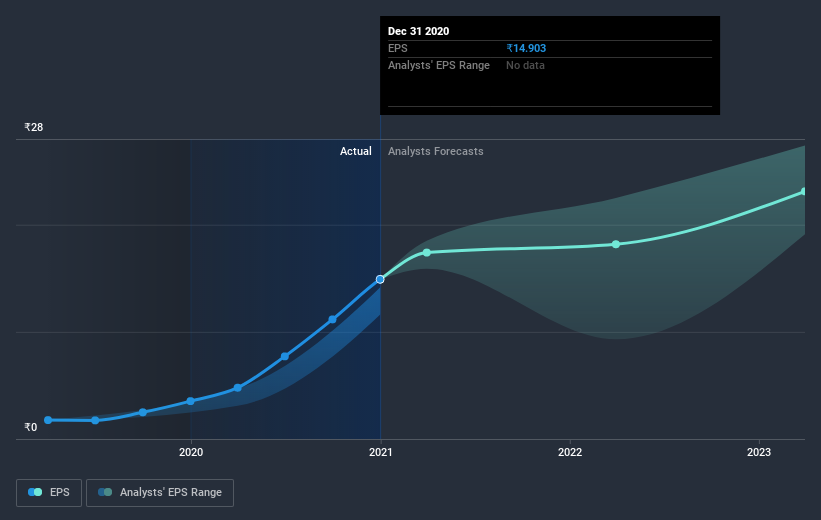

Laurus Labs was able to grow EPS by 320% in the last twelve months. This EPS growth is remarkably close to the 331% increase in the share price. This makes us think the market hasn't really changed its sentiment around the company, in the last year. It makes intuitive sense that the share price and EPS would grow at similar rates.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Laurus Labs, it has a TSR of 335% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Laurus Labs shareholders have gained 335% (in total) over the last year. And yes, that does include the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 54%. Given the track record of solid returns over varying time frames, it might be worth putting Laurus Labs on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Laurus Labs .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Laurus Labs, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LAURUSLABS

Laurus Labs

Manufactures and sells medicines and active pharmaceutical ingredients (APIs) in India and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives