Shareholders Would Not Be Objecting To Kilitch Drugs (India) Limited's (NSE:KILITCH) CEO Compensation And Here's Why

Key Insights

- Kilitch Drugs (India) to hold its Annual General Meeting on 29th of September

- Salary of ₹6.00m is part of CEO Mukund Mehta's total remuneration

- Total compensation is similar to the industry average

- Over the past three years, Kilitch Drugs (India)'s EPS grew by 62% and over the past three years, the total shareholder return was 202%

The performance at Kilitch Drugs (India) Limited (NSE:KILITCH) has been quite strong recently and CEO Mukund Mehta has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 29th of September. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for Kilitch Drugs (India)

Comparing Kilitch Drugs (India) Limited's CEO Compensation With The Industry

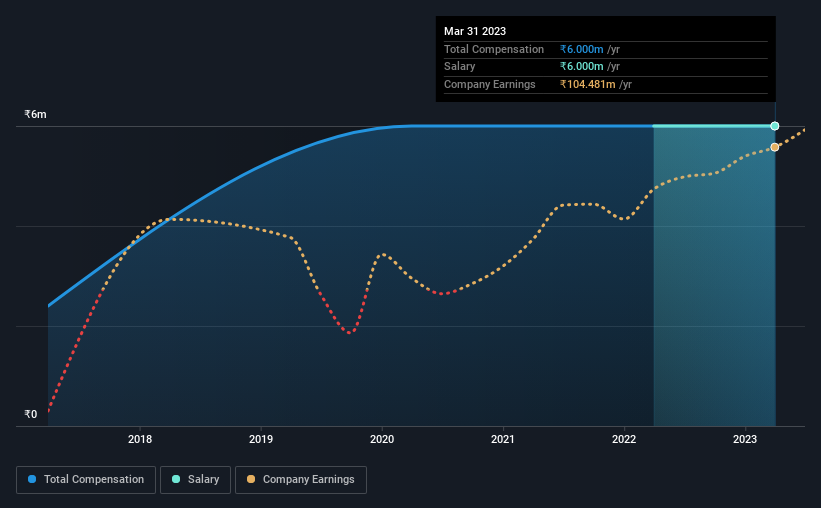

At the time of writing, our data shows that Kilitch Drugs (India) Limited has a market capitalization of ₹3.9b, and reported total annual CEO compensation of ₹6.0m for the year to March 2023. This was the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹6.0m.

For comparison, other companies in the Indian Pharmaceuticals industry with market capitalizations below ₹17b, reported a median total CEO compensation of ₹5.1m. This suggests that Kilitch Drugs (India) remunerates its CEO largely in line with the industry average. What's more, Mukund Mehta holds ₹222m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹6.0m | ₹6.0m | 100% |

| Other | - | - | - |

| Total Compensation | ₹6.0m | ₹6.0m | 100% |

Speaking on an industry level, nearly 96% of total compensation represents salary, while the remainder of 4% is other remuneration. Speaking on a company level, Kilitch Drugs (India) prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Kilitch Drugs (India) Limited's Growth

Kilitch Drugs (India) Limited has seen its earnings per share (EPS) increase by 62% a year over the past three years. In the last year, its revenue is up 11%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Kilitch Drugs (India) Limited Been A Good Investment?

Boasting a total shareholder return of 202% over three years, Kilitch Drugs (India) Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Kilitch Drugs (India) pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Kilitch Drugs (India) that investors should think about before committing capital to this stock.

Important note: Kilitch Drugs (India) is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Kilitch Drugs (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KILITCH

Kilitch Drugs (India)

Engages in the development and operation of pharmaceutical business in India.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives