Ind-Swift Laboratories (NSE:INDSWFTLAB) delivers shareholders massive 36% CAGR over 5 years, surging 11% in the last week alone

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. Don't believe it? Then look at the Ind-Swift Laboratories Limited (NSE:INDSWFTLAB) share price. It's 367% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. And in the last week the share price has popped 11%.

Since the stock has added ₹658m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Ind-Swift Laboratories

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

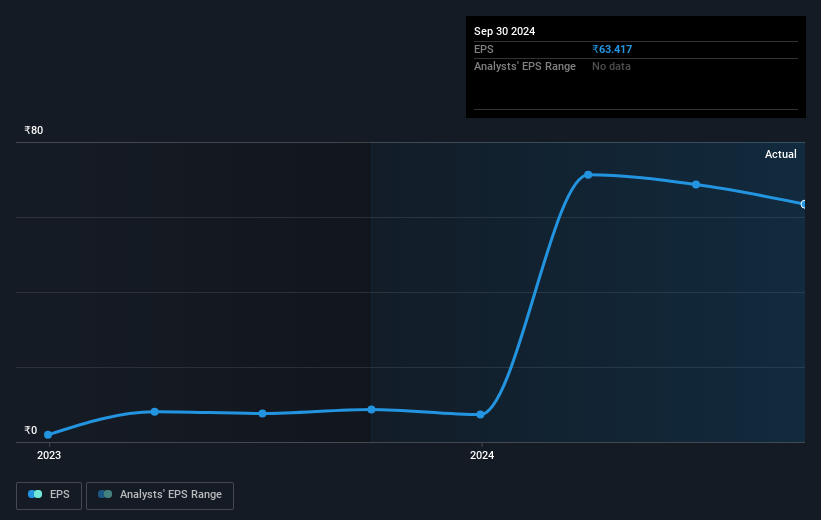

During the last half decade, Ind-Swift Laboratories became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the Ind-Swift Laboratories share price has gained 46% in three years. Meanwhile, EPS is up 144% per year. This EPS growth is higher than the 13% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 1.77.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Ind-Swift Laboratories' earnings, revenue and cash flow.

A Different Perspective

Ind-Swift Laboratories shareholders gained a total return of 4.6% during the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 36% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Ind-Swift Laboratories better, we need to consider many other factors. Take risks, for example - Ind-Swift Laboratories has 2 warning signs (and 1 which is significant) we think you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDSWFTLAB

Ind-Swift Laboratories

Develops, manufactures, and sells active pharmaceutical ingredients (APIs), intermediates, and formulations in India and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.