Bliss GVS Pharma (NSE:BLISSGVS) Is Due To Pay A Dividend Of ₹0.50

The board of Bliss GVS Pharma Limited (NSE:BLISSGVS) has announced that it will pay a dividend on the 24th of August, with investors receiving ₹0.50 per share. The dividend yield is 0.5% based on this payment, which is a little bit low compared to the other companies in the industry.

View our latest analysis for Bliss GVS Pharma

Bliss GVS Pharma's Dividend Is Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, Bliss GVS Pharma's earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

Unless the company can turn things around, EPS could fall by 9.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 7.5%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

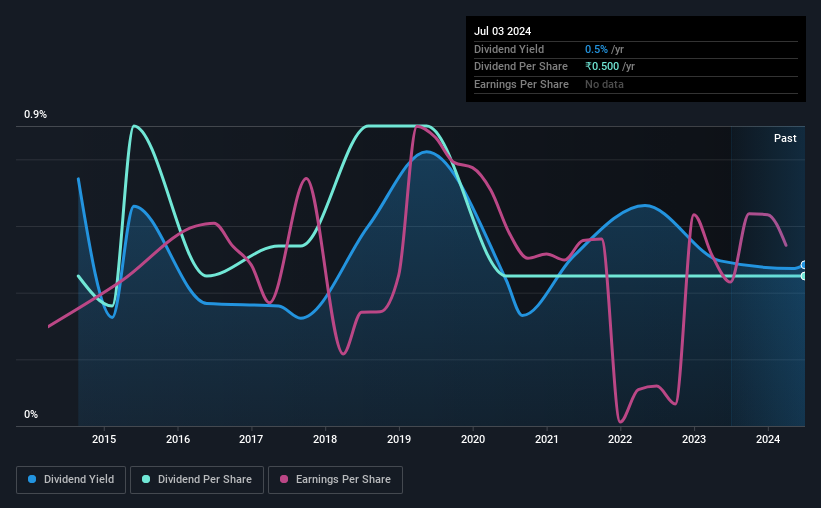

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. There hasn't been much of a change in the dividend over the last 10 years. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Is Doubtful

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. In the last five years, Bliss GVS Pharma's earnings per share has shrunk at approximately 9.7% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

Our Thoughts On Bliss GVS Pharma's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Bliss GVS Pharma (of which 1 is a bit concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

If you're looking to trade Bliss GVS Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bliss GVS Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLISSGVS

Bliss GVS Pharma

Develops, manufactures, and markets pharmaceutical formulations in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives