Aurobindo Pharma Limited (NSE:AUROPHARMA) Doing What It Can To Lift Shares

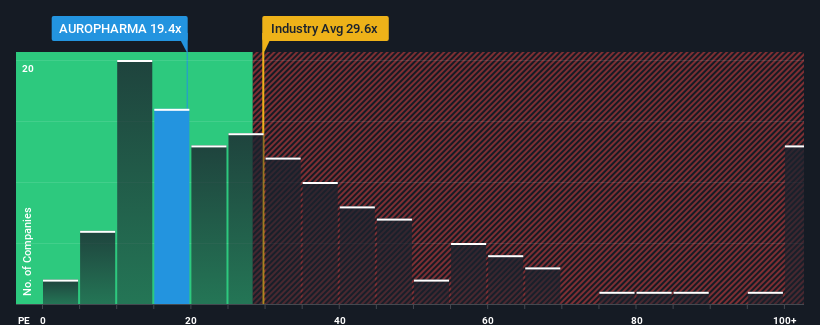

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 26x, you may consider Aurobindo Pharma Limited (NSE:AUROPHARMA) as an attractive investment with its 19.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Aurobindo Pharma has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Aurobindo Pharma

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Aurobindo Pharma's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 27%. As a result, it also grew EPS by 23% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 23% as estimated by the analysts watching the company. That's shaping up to be similar to the 25% growth forecast for the broader market.

In light of this, it's peculiar that Aurobindo Pharma's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Aurobindo Pharma's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Aurobindo Pharma with six simple checks on some of these key factors.

If you're unsure about the strength of Aurobindo Pharma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AUROPHARMA

Aurobindo Pharma

A biopharmaceutical company, engages in the manufacture of generic formulations and active pharmaceutical ingredients in India, the United States of America, Europe, Puerto Rico, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives