Ajanta Pharma (NSE:AJANTPHARM) Will Pay A Dividend Of ₹9.50

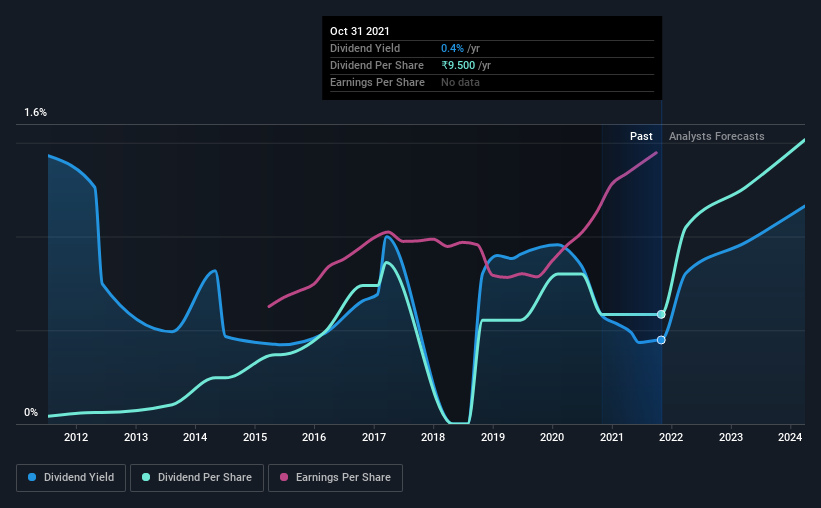

Ajanta Pharma Limited (NSE:AJANTPHARM) has announced that it will pay a dividend of ₹9.50 per share on the 28th of November. The dividend yield is 0.4% based on this payment, which is a little bit low compared to the other companies in the industry.

Check out our latest analysis for Ajanta Pharma

Ajanta Pharma's Dividend Is Well Covered By Earnings

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Before making this announcement, Ajanta Pharma was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 11.4%. If the dividend continues on this path, the payout ratio could be 10% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the first annual payment was ₹0.67, compared to the most recent full-year payment of ₹9.50. This means that it has been growing its distributions at 30% per annum over that time. Ajanta Pharma has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

We Could See Ajanta Pharma's Dividend Growing

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. We are encouraged to see that Ajanta Pharma has grown earnings per share at 9.2% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

We Really Like Ajanta Pharma's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for Ajanta Pharma that investors should know about before committing capital to this stock. We have also put together a list of global stocks with a solid dividend.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AJANTPHARM

Ajanta Pharma

A specialty pharmaceutical formulation company, together with its subsidiaries, develops, manufactures, and markets speciality pharmaceutical finished dosages.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives